75 Maps

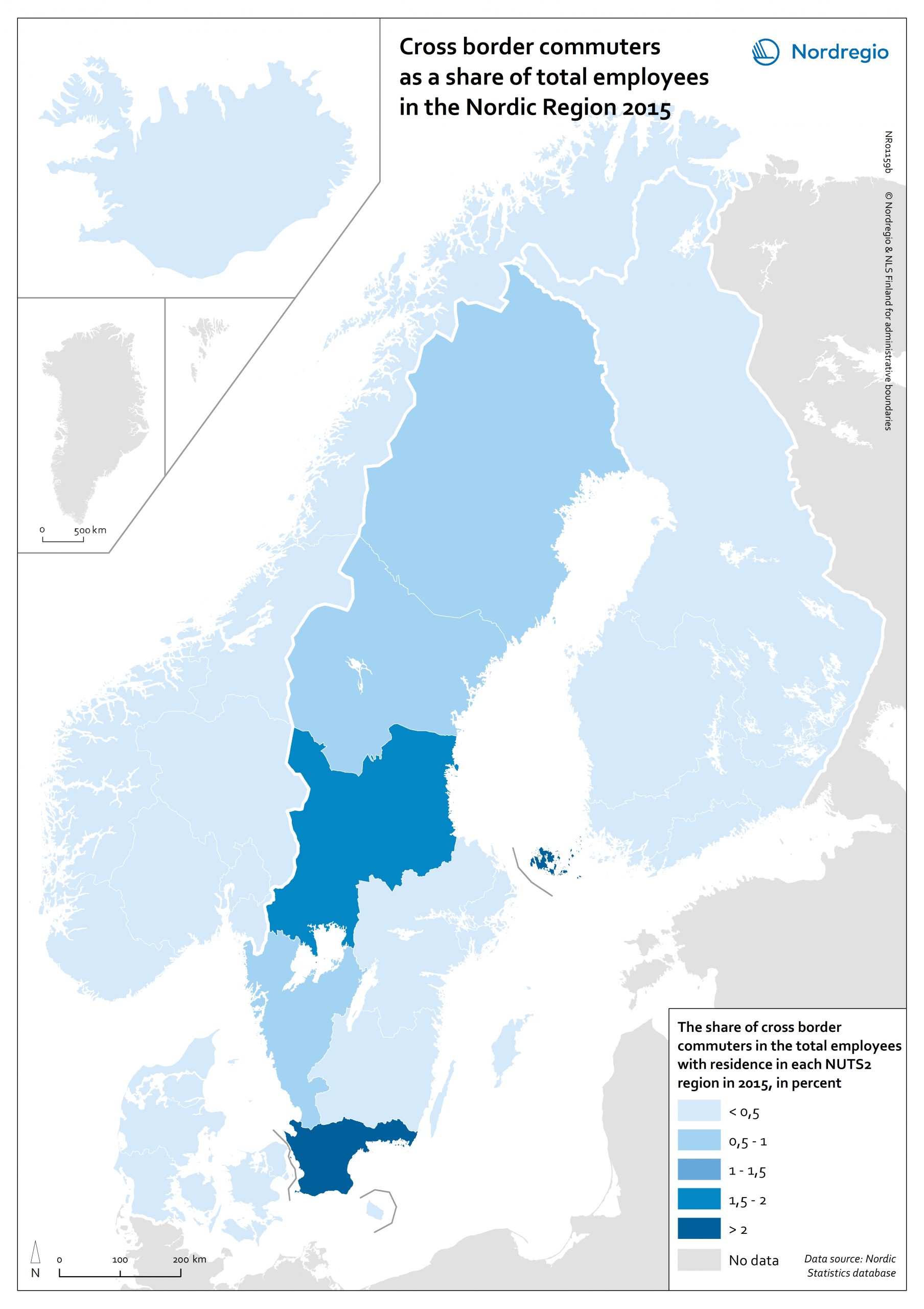

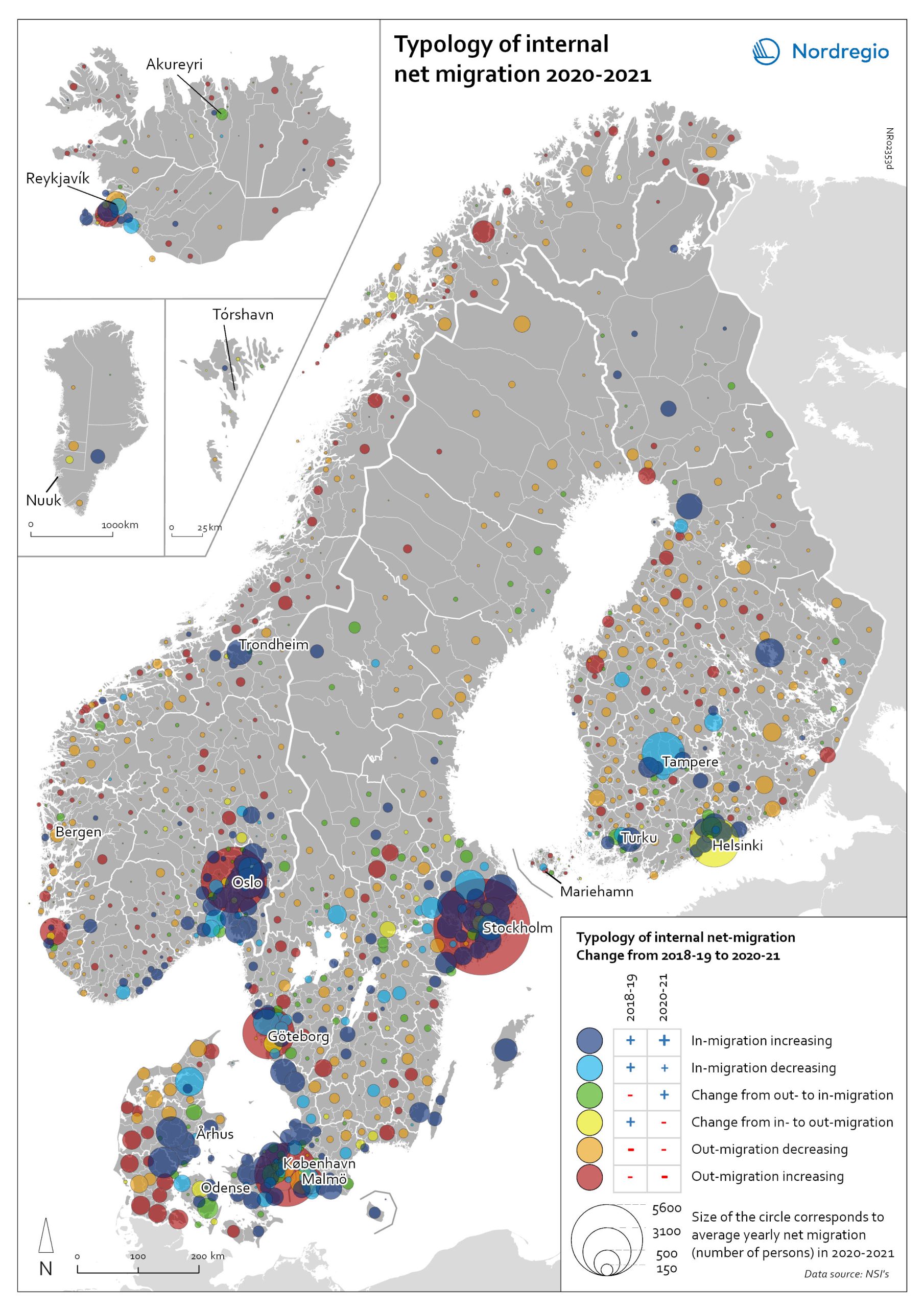

Typology of internal net migration 2020-2021

The map presents a typology of internal net migration by considering average annual internal net migration in 2020-2021 alongside the same figure for 2018-2019. The colours on the map correspond to six possible migration trajectories: Dark blue: Internal net in migration as an acceleration of an existing trend (net in-migration in 2020-2021 + increase compared to 2018-2019) Light blue: Internal net in migration but at a slower rate than previously (net in-migration in 2020-2021 + decrease compared to 2018-2019) Green: Internal net in migration as a new trend (net in-migration in 2020-2021 + change from net out-migration compared to 2018-2019) Yellow: Internal net out migration as a new trend (net out-migration in 2020-2021 + change from net in-migration compared to 2018-2019) Orange: Internal net out migration but at a slower rate than previously (net out-migration in 2020-2021 + decrease compared to 2018-2019) Red: Internal net out migration as a continuation of an existing trend (net out-migration in 2020-2021 + increase compared to 2018-2019) The patterns shown around the larger cities reinforces the message of increased suburbanisation as well as growth in smaller cities in proximity to large ones. In addition, the map shows that this is in many cases an accelerated (dark blue circles), or even new development (green circles). Interestingly, although accelerated by the pandemic, internal out migration from the capitals and other large cities was an existing trend. Helsinki stands out as an exception in this regard, having gone from positive to negative internal net migration (yellow circles). Similarly, slower rates of in migration are evident in the two next largest Finnish cities, Tampere and Turku (light blue circles). Akureyri (Iceland) provides an interesting example of an intermediate city which began to attract residents during the pandemic despite experiencing internal outmigration prior. From a rural perspective there are…

2022 May

- Demography

- Migration

- Nordic Region

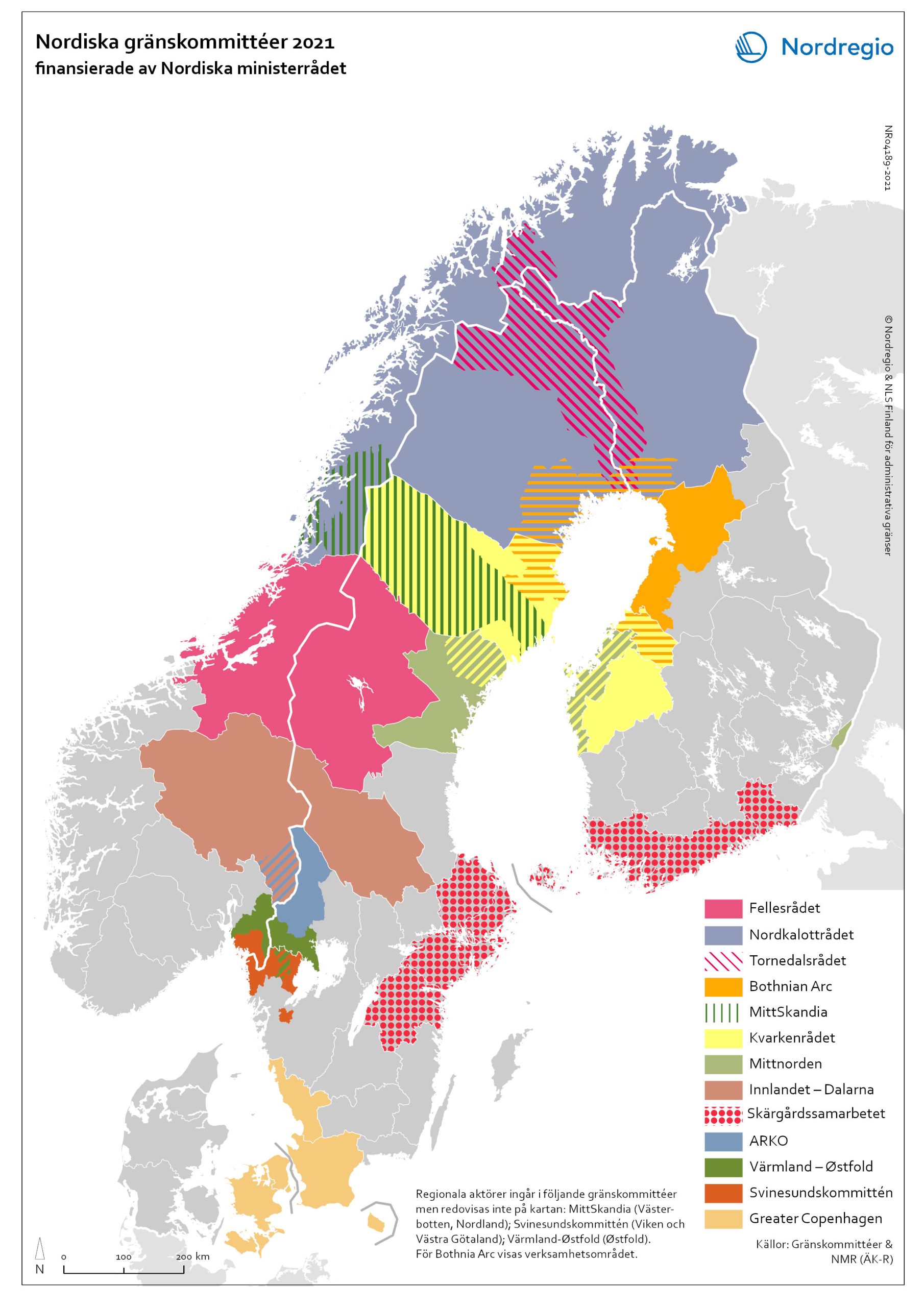

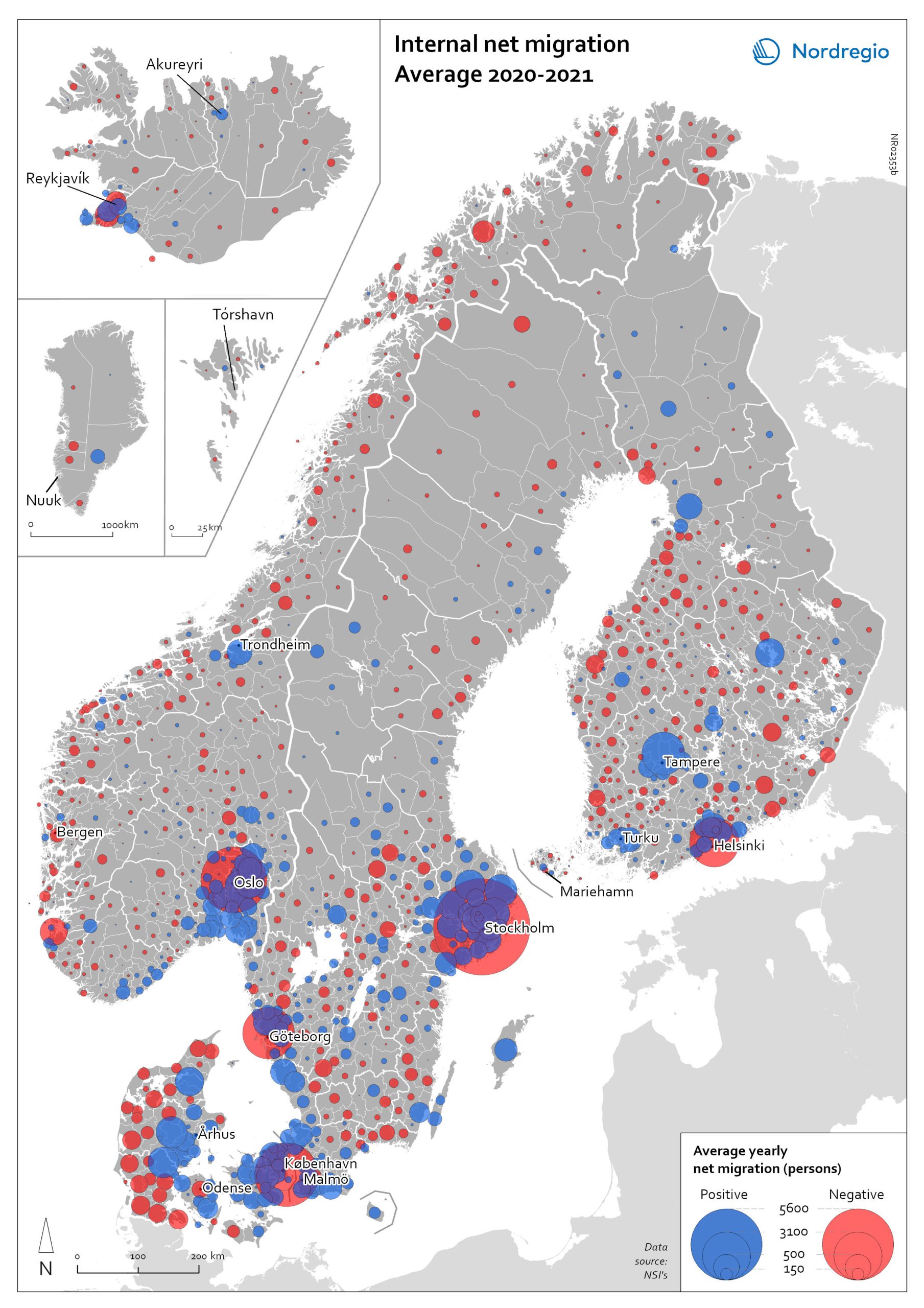

Internal net migration 2020-2021

The map shows the average internal net migration in 2020 and 2021 for Nordic municipalities. Blue dots indicate positive internal net migration (more people moving in than out) and red dots indicate negative internal net migration (more people moving out than in), while the size of the dots represents the extent of the positive or negative trend. Internal migration refers to a change of address within the same country. The map shows substantial outmigration from the Nordic capitals, as well as from Gothenburg and Malmö in Sweden. Alongside increased suburbanisation, the map also provides some evidence of growth in medium-sized cities and smaller cities within commuting distance of larger cities.

2022 May

- Demography

- Migration

- Nordic Region

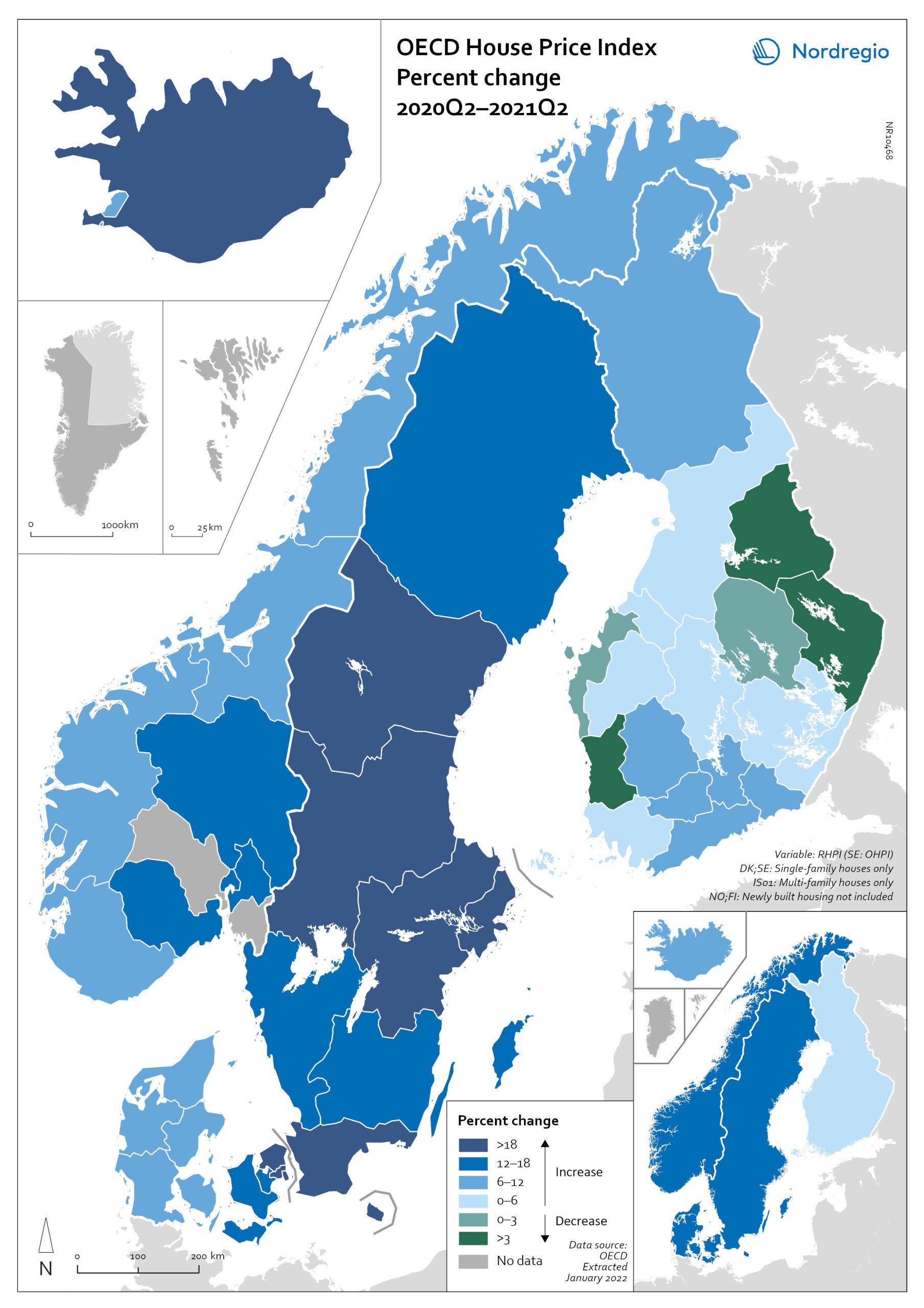

OECD House Price Index. Change 2020Q2–2021Q2

The map shows the relative change of the OECD House Price Index from Q2 2020 to Q2 2021. The map shows that the price development was not uniform within the countries. Iceland recorded the largest price increases overall, with the most marked price increases found outside of the capital region. All Swedish regions recorded increases above 20%, with the highest increases in the Stockholm and Malmö regions. All Norwegian regions showed price increases, though to a lesser extent than Swedish regions in most cases. In Denmark, Bornholm, Sjælland and the rural islands of Lolland and Falster recorded relatively high price increases, although many rural areas developed from low absolute prices in 2020. Finland was the only country where some regions saw property prices decrease. Moderate increases were still observed in some of the southern regions, where the major cities are located, and in the north.

2022 March

- Economy

- Nordic Region

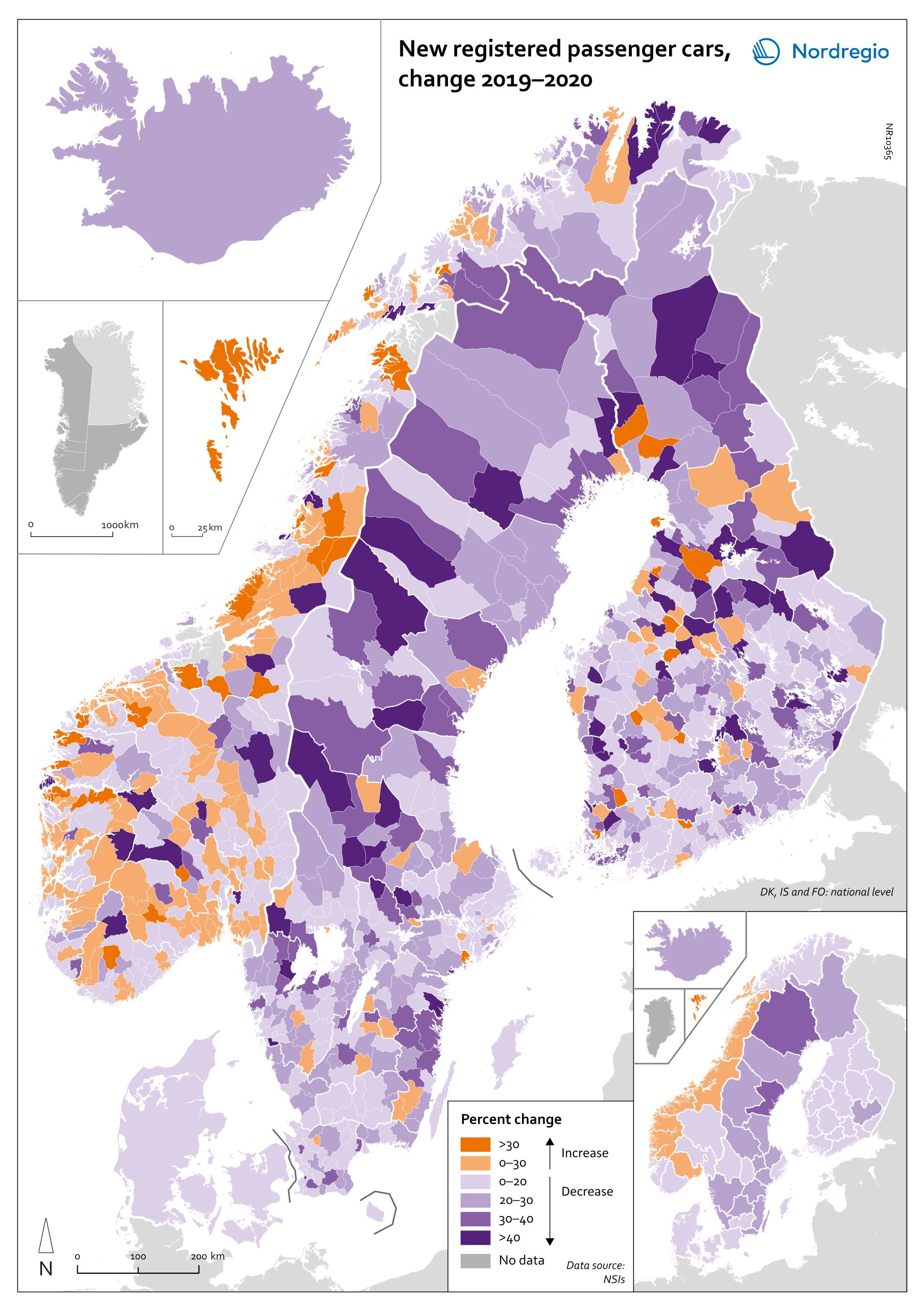

Change in new registered cars 2019-2020

The map shows the change in new registered passenger cars from 2019 to 2020. In most countries, the number of car registrations fell in 2020 compared to 2019. On a global scale, it is estimated that sales of motor vehicles fell by 14%. In the EU, passenger car registrations during the first three quarters of 2020 dropped by 28.8%. The recovery of consumption during Q4 2020 brought the total contraction for the year down to 23.7%, or 3 million fewer cars sold than in 2019. In the Nordic countries, consumer behaviour was consistent overall with the EU and the rest of the world. However, Iceland, Sweden, Finland, Åland, and Denmark recorded falls of 22%–11% – a far more severe decline than Norway, where the market only fell by 2.0%. The Faroe Islands was the only Nordic country to record more car registrations, up 15.8% in 2020 compared to 2019. In Finland, Iceland, Norway, and Sweden, there were differences in car registrations in different parts of the country. In Sweden and Finland, the position was more or less the same in the whole of the country, with only a few municipalities sticking out. In Finland and Sweden, net increases in car registrations were concentrated in rural areas, while in major urban areas, such as Uusimaa-Nyland in Finland and Västra Götaland and Stockholm in Sweden, car sales fell between 10%–22%. Net increases in Norway were recorded in many municipalities throughout the whole country in 2020 compared to 2019.

2022 March

- Economy

- Nordic Region

- Transport

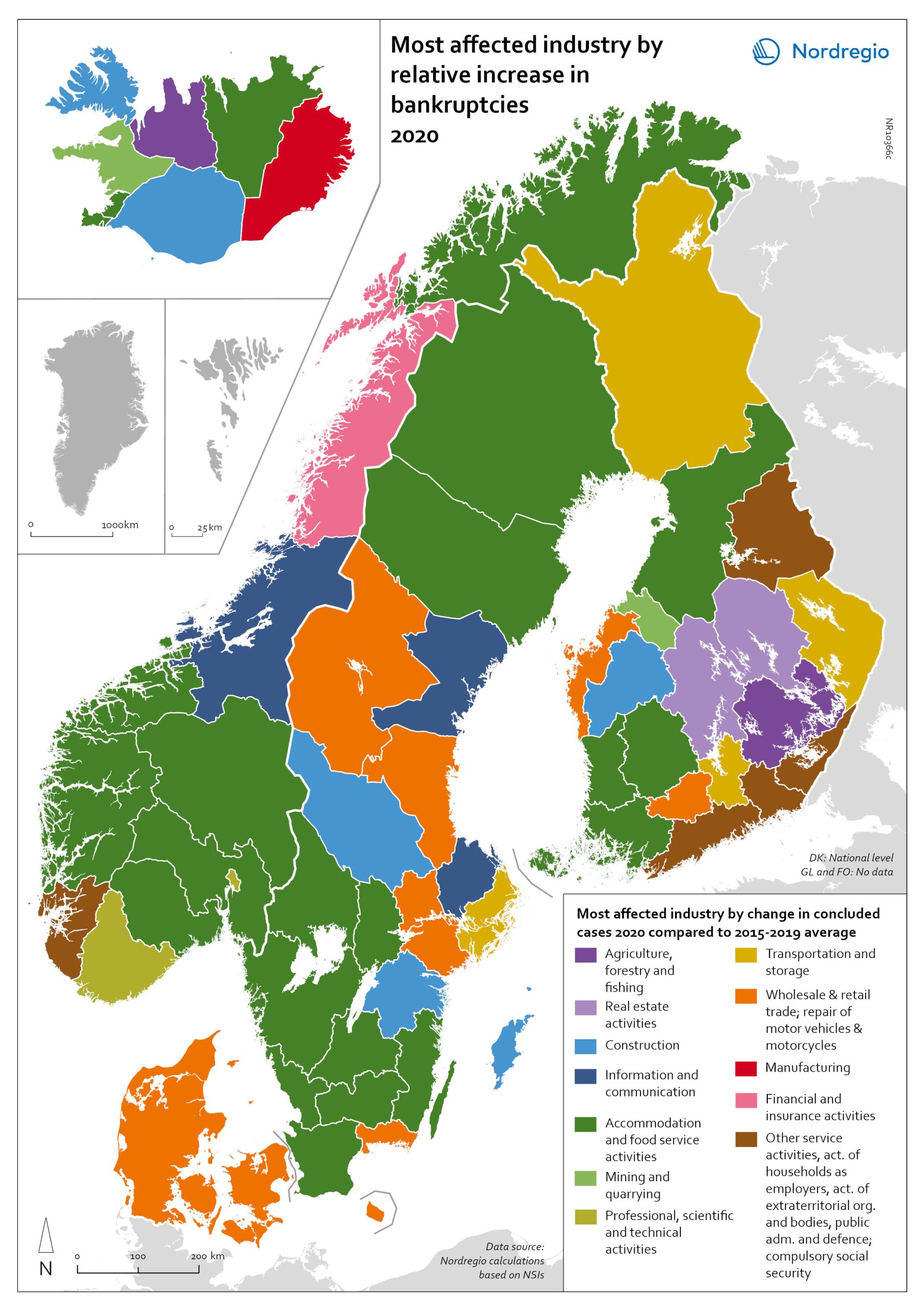

Bankruptcies in 2020 by industry and region

The map shows the most affected industry by relative increase in concluded business bankruptcies 2020 compared to 2015–2019 average. Regional patterns in business failures are linked to factors ranging from the effectiveness of the measures adopted by the various governments to the exposure of regional economies to vulnerable sectors. Regions with higher numbers of bankruptcies tend to reflect the concentration of economic activity in sectors particularly affected by the pandemic. It comes as little surprise that Accommodation and food service activities were the industries with the largest increase in business bankruptcies in 2020 compared to the 2015–2019 baseline. In the Nordic Region as a whole, the number rose by 28.6%. This pattern is also discernible at the regional level. Hotels and restaurants were the activities with the biggest increase in the number of bankruptcies in a significant number of Swedish, Norwegian and Finnish regions. Other sectors suffering higher-than-average numbers of business bankruptcies are service industries, particularly those requiring closer social interaction, like Education (16.5% increase), Other service activities (12.0% increase) and Administrative and support service activities (7.9% increase). The logistics sector was also greatly affected, with major impact localised around logistics centres and transport nodes in the different countries. In the capital regions of Oslo, Stockholm and Helsinki, Transportation and storage was the sector with the largest increase in bankruptcies. Wholesale and retail trade; repair of motor vehicles and motorcycles was the industry to suffer the most in Denmark and several Finnish and Swedish regions.

2022 March

- Economy

- Nordic Region

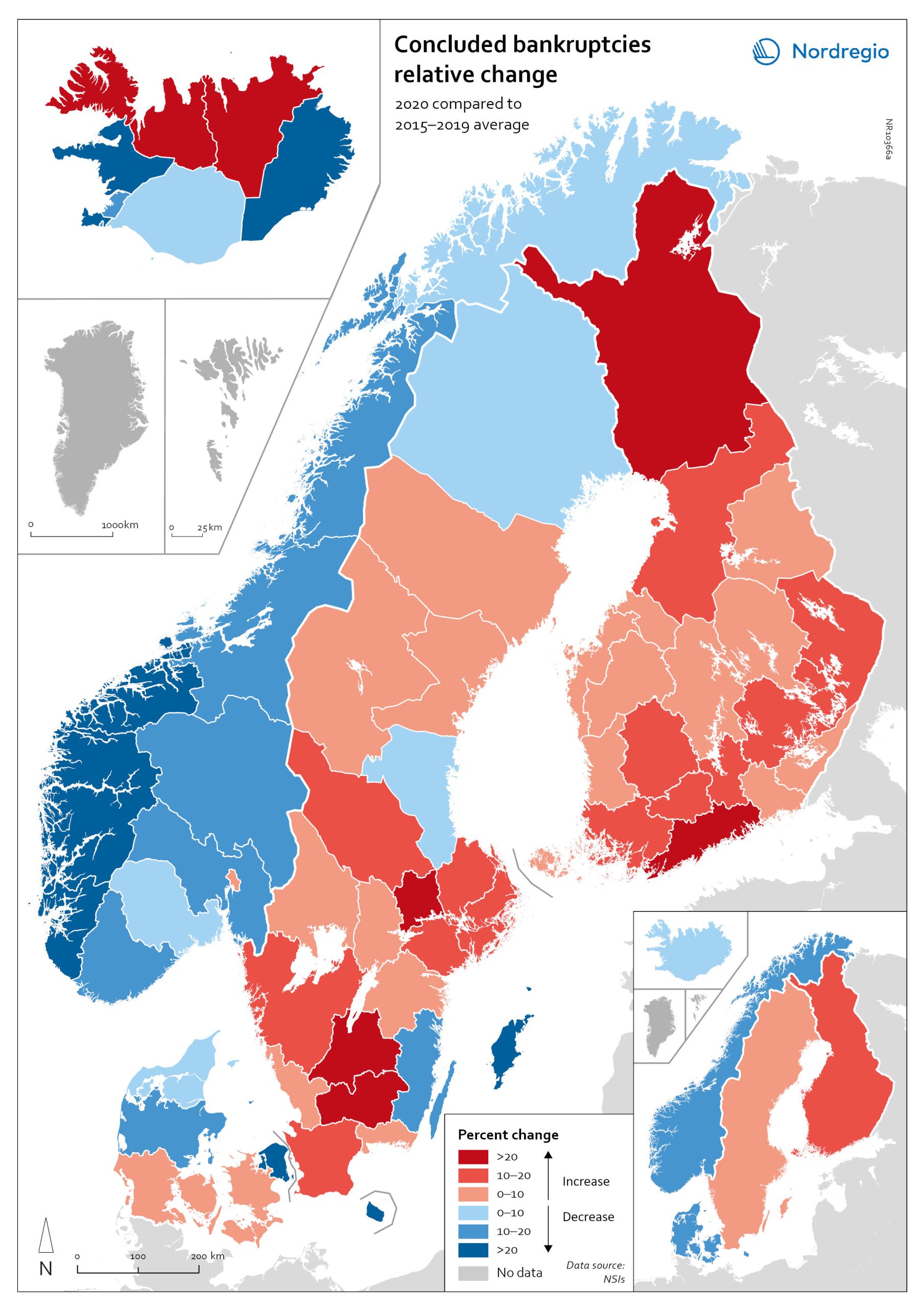

Relative change in the number of business bankruptcies

The map shows the relative change in the number of concluded business bankruptcies by region, 2015–2019 average compared to 2020. At sub-national levels, the distribution of business bankruptcies does not show a clear territorial pattern. In Iceland and Denmark, businesses in the most urbanised areas, including the capital regions, seem to have been those that benefited most from the economic mitigation measures (-23.9% in Höfuðborgarsvæðið and -24.4% in Region Hovedstaden). By contrast, Oslo is the only Norwegian region where there were more business bankruptcies in 2020 compared to the 2015–2019 baseline (1.9% increase). Most Norwegian regions did, in fact, have fewer bankruptcies in 2020, particularly in the western regions. One plausible explanation for this could be that the number of business failures during the baseline period was especially high in western Norway due to the fall in oil prices in 2014–2015. In Sweden the situation is even more mixed. Here, businesses in urban areas seem to have been more exposed to the distress caused by the Covid-19 pandemic. The most urbanised regions in the Stockholm-Gothenburg-Malmö corridor registered a greater increase in liquidations (Jönköping, Kronoberg and Södermanland regions saw surges of around 20%). However, predominantly rural regions in Sweden, such as Västerbotten and Jämtland, also recorded higher numbers of bankruptcies than average (9.8% and 8.8% increase, respectively). In Finland, the impact was greater in Lapland (26.9%) and around Helsinki (Uusimaa, 25.9%) than in the central parts of the country. Åland also experienced a moderate rise in business bankruptcies in 2020 (4.0%), mostly related to the tourism sector.

2022 March

- Economy

- Nordic Region

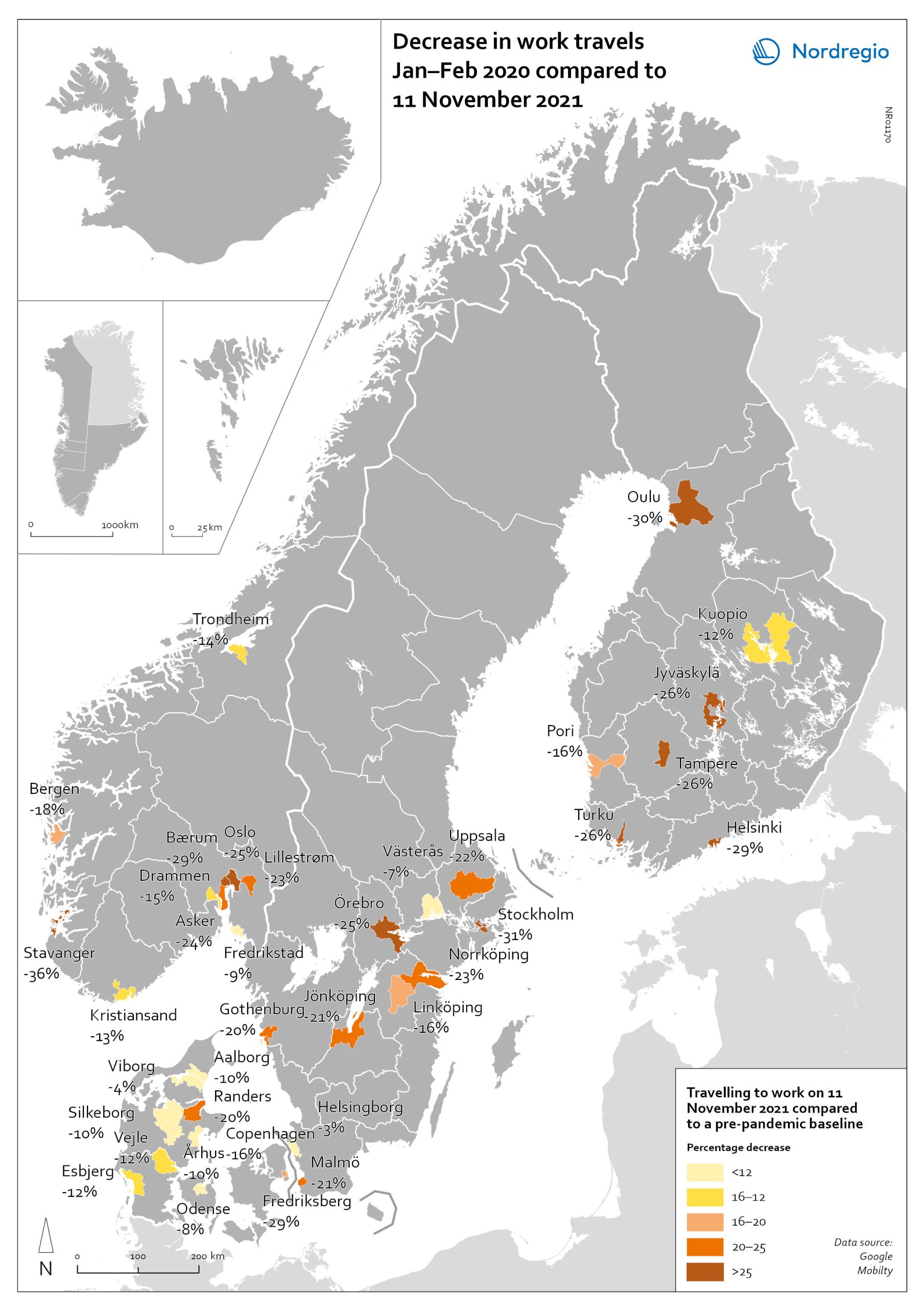

Change in work travels Jan-Feb 2020 compared to Nov 2021

The map shows changes in number of people travelling to work in the Nordic municipalities with the biggest populations comparing November 2021 to a pre-pandemic baseline. The map compares the average number of people who travelled to work on a weekday in January and February 2020 with the number of people who travelled to work on 11 November 2021 in the ten largest cities of Denmark, Finland, Norway and Sweden. The date was selected as the reference date as it is considered to be a relatively typical Thursday. It also represents a point when few movement restrictions were in place in the Nordic countries. As can be seen from the map, all of the municipalities highlighted recorded a fall in work-related travel on 11 November compared to the pre-pandemic baseline. It was biggest in Stavanger (-36%), followed by Stockholm (-31%), Oulu (-30%), Bærum (adjacent to Oslo) (-29%), Frederiksberg (adjacent to Copenhagen) (-29%) and Helsinki (-29%). In general, the decrease was highest around the capital regions and larger cities, but there were exceptions, for example, Jyväskylä (-26%), Örebro (-25%), Jönköping (-21%), and Randers (-20%). Several large municipalities also stood out because their patterns did not change so much, for example, Helsingborg (-3%) and Västerås (-7%) in Sweden; Viborg (-3%) and Odense (-8%) in Denmark.

2022 March

- Labour force

- Nordic Region

- Transport

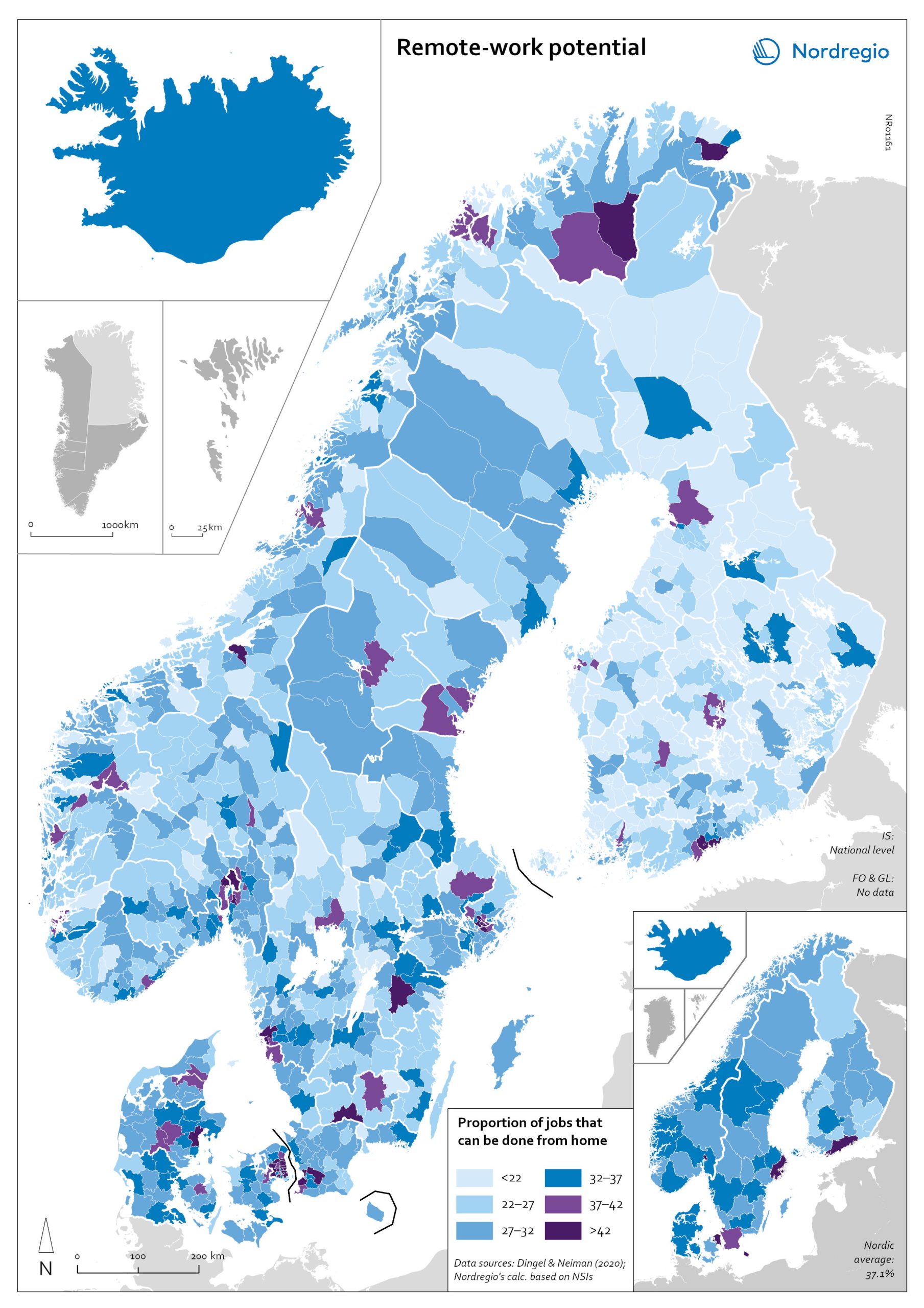

Remote work potential

The map shows the share of jobs that can potentially be done from home. At the municipal level it shows that the highest proportion is in, or in the proximity of, the largest urban conurbations. The purple areas show the municipalities that has a remote-work potential above the Nordic average (37%) and the blue areas the municipalities with remote-work potential below the Nordic average. The indicator is based on the methodology of Dingel & Neiman (2020). This method estimates the proportion of jobs that can theoretically be performed from home based on the tasks included in different occupations. Dingel & Neiman’s US classification was translated to the European International Standard Classification of Operations (ISCO-08) codes. The data is based on the 4-digit ISCO-08 and includes 437 occupations. The result was that every 4-digit ISCO occupation was coded as either 1: possible to work from home or not possible to work from home. For more information about the method please look at the State of the Nordic Region 2022 publication. The ten municipalities with the highest proportions are all in capital regions, with seven out of 10 in either Copenhagen (Hovedstaden) or Stockholm Region. In general, people in urban municipalities are more likely to be able to work from home (46.2%) than those in intermediate municipalities (32.3%) and rural municipalities (27.8%). It seems to be the case that the higher proportion of jobs that can be done from home in urban areas relates to the differences in industrial and occupational profiles between urban and rural areas, in particular, a higher concentration of knowledge-intensive occupations in urban areas. These differences are also evident when comparing countries. For example, Denmark has a rather large number of municipalities with high proportions of jobs that can be done from home. This may be due to…

2022 March

- Labour force

- Nordic Region

Largest Nordic minority 2021

The map shows the largest Nordic-born minority group at the municipal level among the working-age population (15-64 years old). The intensity of the colour shows the share of the total foreign-born Nordic population, with darker tints indicating a larger percentage than lighter tints. The map illustrates differences at the regional and municipal levels within the countries. For example, while the largest minority in Norway are born in Sweden, those born in Denmark constitute the largest minority Nordic-born group in the southern Norwegian region of Agder. The largest Nordic-born minority in Denmark are those born in Sweden in absolute numbers and in the capital region of Hovedstaden, while the largest minority in all other Danish regions is from Greenland. In Sweden, the largest Nordic-born minority overall are from Finland, but there are also regional differences here: in the regions of Skåne, Halland and Kronoberg, the largest Nordic minority group come from Denmark, and in Värmland and Jämtland-Härjedalen, the largest is Norwegian born. In the cross-border municipalities, this pattern is even more accentuated and made evident in areas such as Haparanda in Sweden (the twin city of Tornio in Finland) where 26.5% of the population is Finnish born. Åland has the highest share of other Nordic nationals, where, for example, 47% of the population in the municipality of Kökar is born in a different Nordic country (including Finnish born). Excluding the municipalities of Åland, Haparanda is the municipality in which Nordic-born minorities make up the highest percentage of the total working-age population.

2022 March

- Demography

- Nordic Region

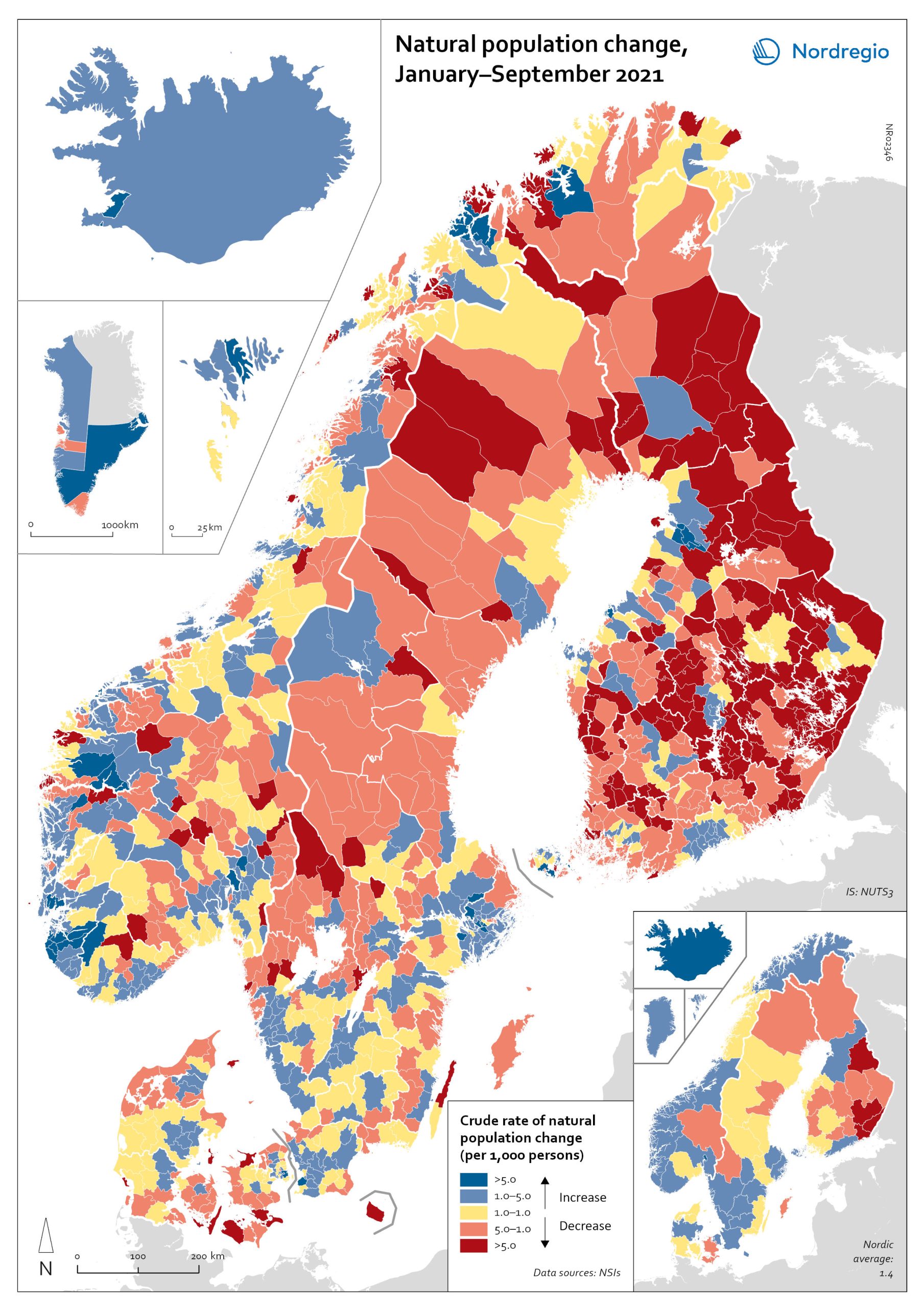

Natural population change in the Nordic Region 2021

The map shows the natural population change in the Nordic Region from January to September 2021 While all Nordic countries except Finland were characterised by positive natural population change during 2021, this growth was often particularly pronounced in and around cities and towns, with their relatively youthful populations. Urban centres and their surrounding areas such as Stockholm and Malmö in Sweden, Oslo and Trondheim in Norway, Espoo and Helsinki in Finland or Aarhus and Copenhagen in Denmark all reported among the highest rates of natural population growth during the first nine months of 2021. Rural regions with their often-older population age structures were more likely to experience natural population decline, a pattern that had already existed prior to the pandemic. Especially in Finland, many rural municipalities reported high natural population decline during the first nine months of 2021, despite increases in the number of births, as shown in the map “Change in the number of births in the Nordics”. In the other Nordic countries, only a few municipalities experienced similarly high levels of natural population decline.

2022 March

- Demography

- Nordic Region

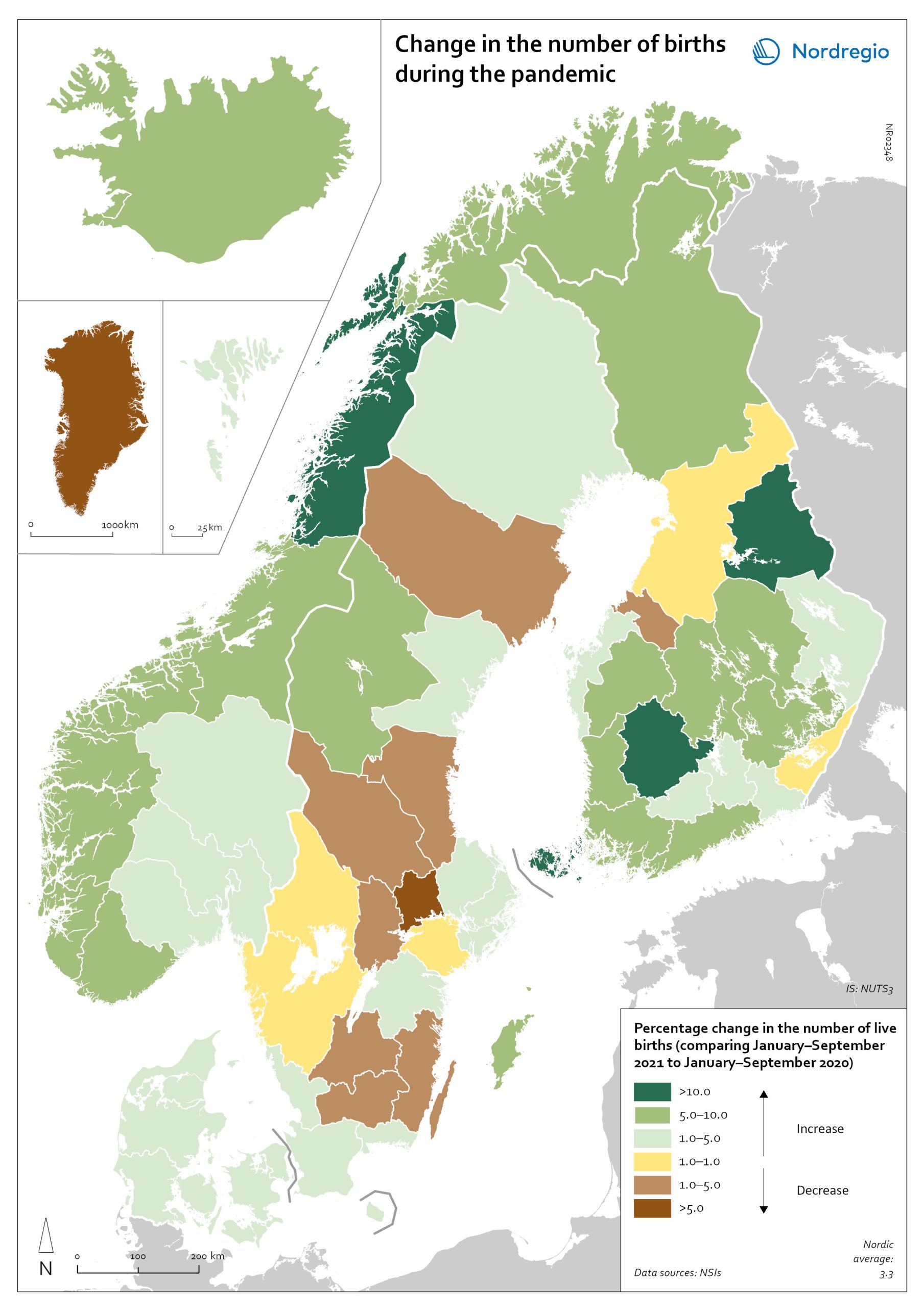

Change in the number of births in the Nordics

The map shows percentage change in the number of live births in Nordic regions, comparing January-September 2021 to the same period in 2020. While most Nordic countries and autonomous territories saw a rise in births during the pandemic, not all regions followed this trend to the same extent. Rural regions stand out as having had both baby booms and baby busts during the pandemic. In Finland, for example, rural regions reported both large increases in births (Kainuu) but also declines (Central Ostrobothnia). In Sweden, only a few regions registered an increase in the number of babies conceived during the pandemic; among those were rural Gotland and Jämtland. Kronoberg and Dalarna, by contrast, reported a drop of more than 3% in the number of births.

2022 March

- Demography

- Nordic Region

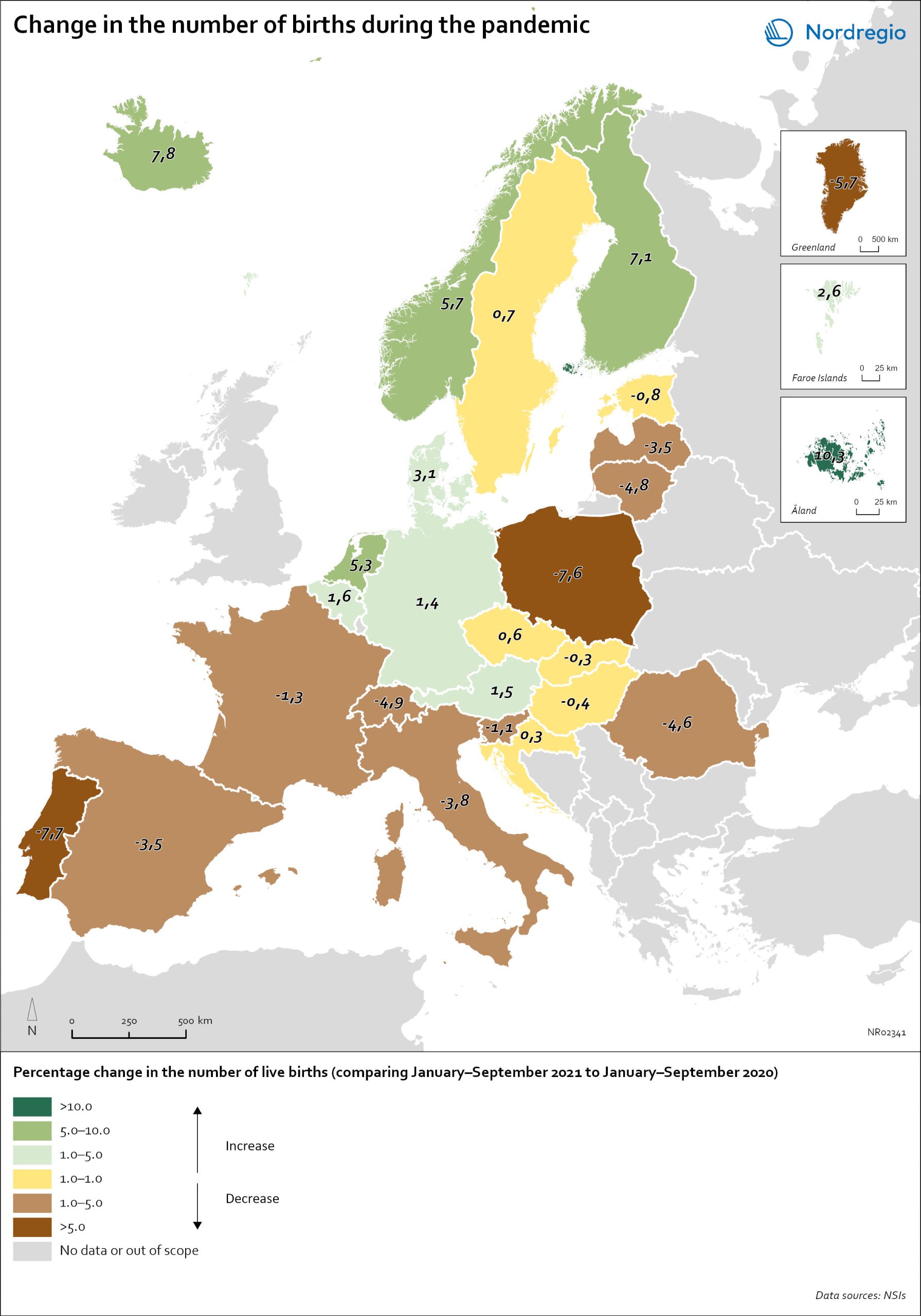

Change in the number of births in Europe

The map shows the number of births during the first nine months of 2021 (January to September) compared to the number of births during the same months in 2020. The babies born during the first nine months of 2021 were conceived between the spring and winter of 2020 when the first waves of the pandemic affected Europe. Babies born during the first nine months of 2020 were conceived in 2019 (i.e., before the pandemic). The map therefore compares the number of births conceived before and during the pandemic. At the time of writing, it seems as if both baby boom and baby bust predictions have been correct, with developments playing out differently across countries. In many Southern and Eastern European countries, such as Spain, Italy or Romania, the number of births declined by more than 1% during the first nine months of 2021. In Portugal and Poland, but also Greenland, drops in the number of births were particularly sharp with more than 5% fewer babies born in 2021. In several of these “baby bust” countries, these decreases in fertility came on top of already low fertility rates. Spain, Italy, Portugal and Poland, for instance, all already had a total fertility rate (TFR) of less than 1.5 children per woman before the crisis. These values are substantially below the so-called ‘replacement ratio’ of 2.1 children per woman, which is necessary to maintain population size. In these countries, existing demographic challenges have thus been aggravated during the pandemic.

2022 March

- Demography

- Europe

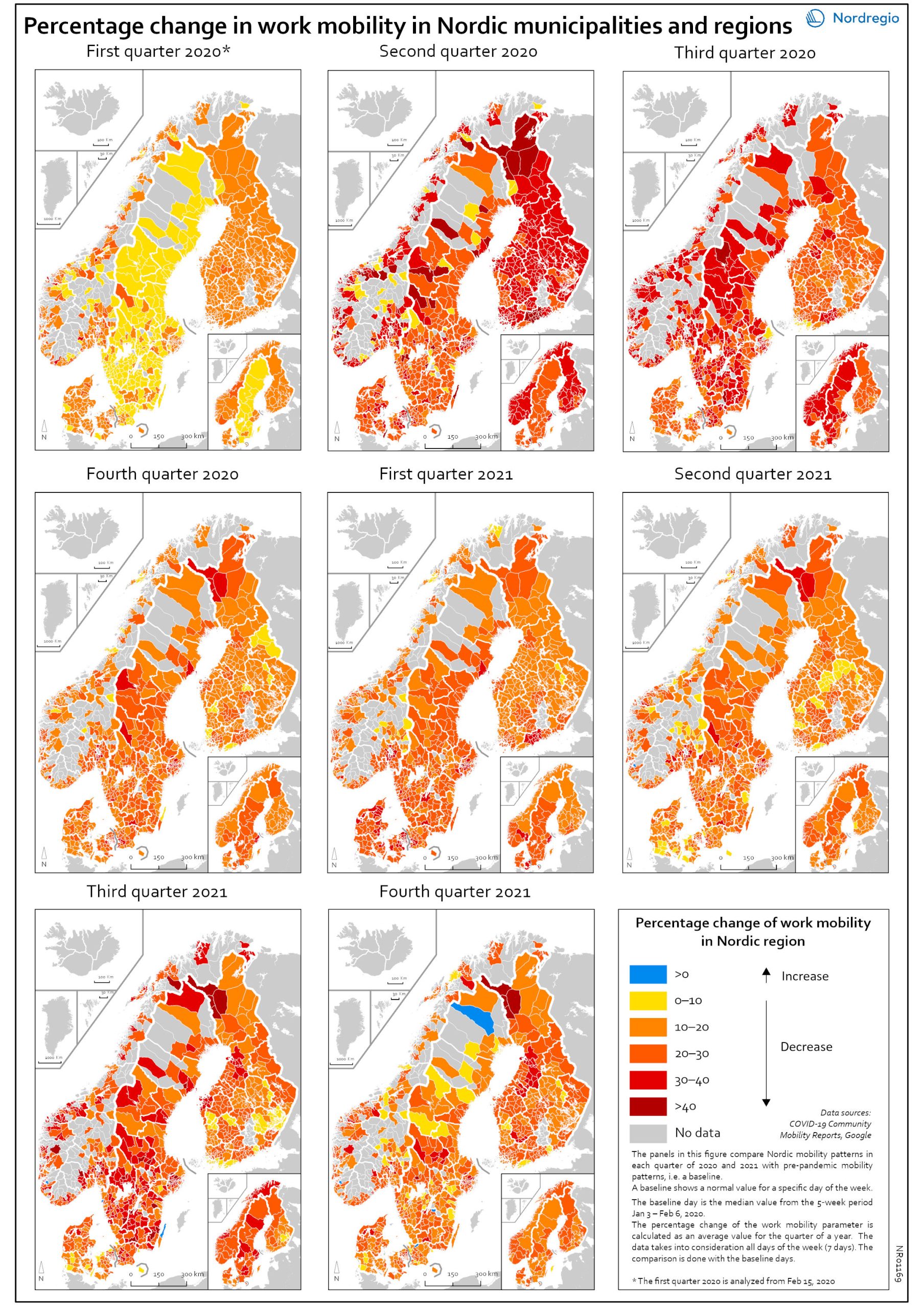

Work mobility per municipality and region by quarter

The map shows the percentage change for work mobility in Nordic regions and municipalities compared to a pre-pandemic baseline. The maps compare Nordic mobility patterns in each quarter of 2020 and 2021 with a pre-pandemic baseline. Based on Google data, the panels illustrate the impact of national restrictions and how those restrictions hampered work mobility. As the restrictions were both national and regional in nature, some regions and municipalities were more affected than others. The darker areas in the map show that work mobility decreased the most Q2 and Q3 2020 and in Q3 2021. The panels also show that mobility decreased later in Sweden than in the other Nordic countries. However, the decrease in Q3 in both 2020 and 2021 may partly be explained by the summer vacation months, when work mobility tends to decrease anyway. In Q4 2021, the overall situation seems to improve, although the pattern is mixed. In a few municipalities the situation is almost back to pre-pandemic baseline while in most municipalities, there is still less mobility in the labour market compared to the pre-pandemic situation.

2022 March

- Labour force

- Nordic Region

- Transport

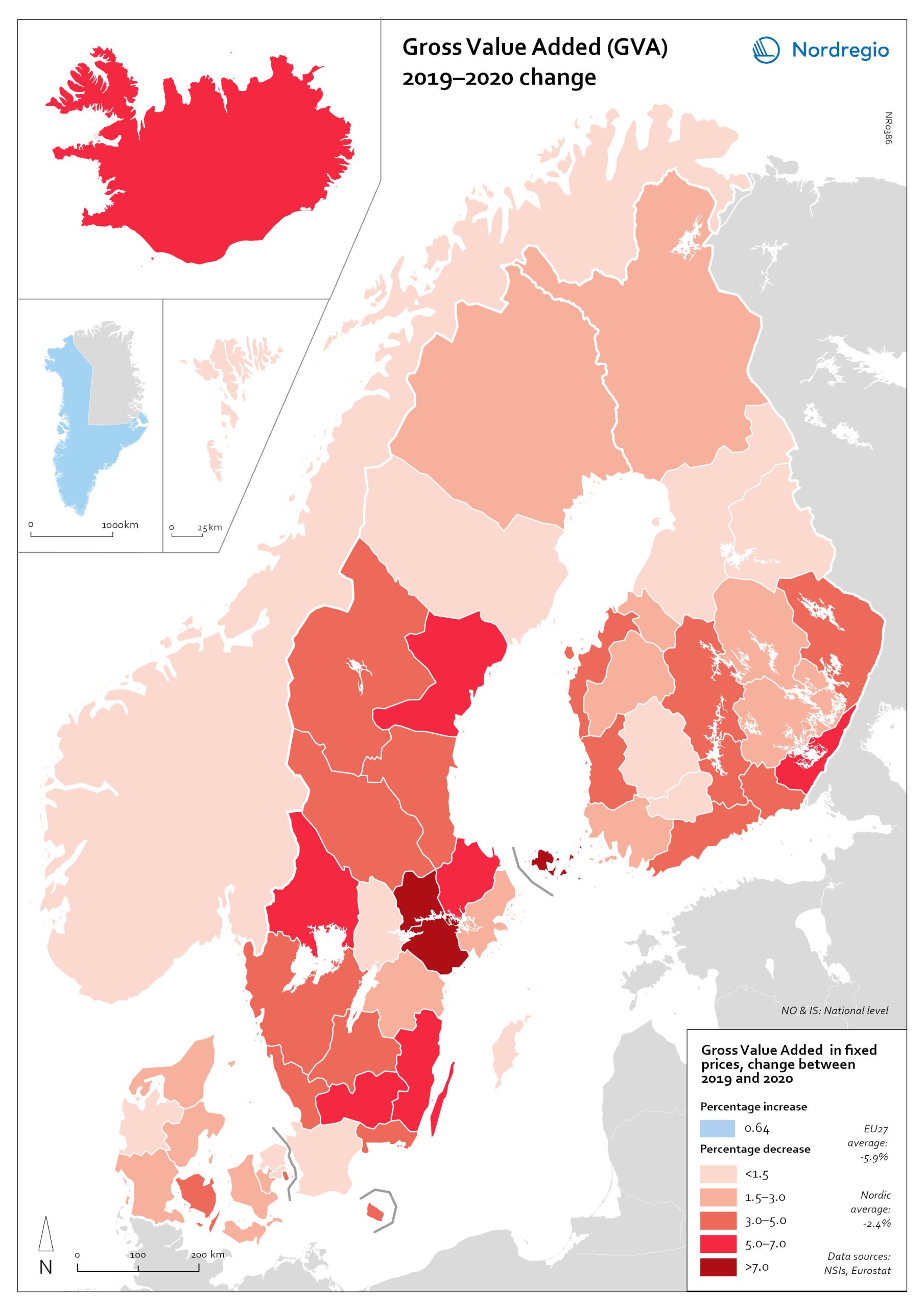

Gross Value Added (GVA) change 2019-2020

The map shows the change in regional Gross Value Added (GVA) from 2019 to 2020 (in fixed prices). As shown in the map, aggregated production levels, in terms of Gross Value Added (GVA), contracted in nearly all of the Nordic regions between 2019 and 2020. In general, the variability was comparatively smaller within each country than it was between countries, even when comparing regions with similar economic profiles from different countries. On average, the impact was greater on regions in Sweden and Finland than those in Denmark. Still, some relevant territorial patterns emerge from the changes to regional GVA shown in the map. The contraction was larger in regions with higher dependence on tourism services and hospitality (Åland and some municipalities in South Karelia, Finland, and Bornholm, Denmark), as well as on mass-market retail and logistics, particularly in the areas surrounding the capital regions (Södermanland and Västmanland in Sweden and Greater Copenhagen in Denmark). In Sweden and Finland, a remarkable regional divide can also be traced between territories specialised in transformation sectors with limited vulnerability to the impact of Covid-19, including forestry and specific types of processing (e.g. pulp, cement), like Nord Ostrobothnia, Kainuu and Pirkanmaa in Finland, and Gotland, Västerbotten and Örebro in Sweden. Aggregated output in these regions fell less than in regions with greater exposure to industrial manufacturing, like Kymenlaakso in Finland and Kronobergs in Sweden. Similarly, the impact on the financial centres in Denmark (Greater Copenhagen) and Sweden (Stockholm) was less than regions with mid-sized cities and diversified urban economies, like Vestjylland (Århus) in Denmark and Upsala in Sweden. Interestingly, the shock to the Finnish economy was greater in the Helsinki metropolitan area (-3.6% Uusimaa) than it was for the Tampere region (-0.5% in Pirkanmaa). This may be due to the relatively higher concentration…

2022 March

- Economy

- Nordic Region

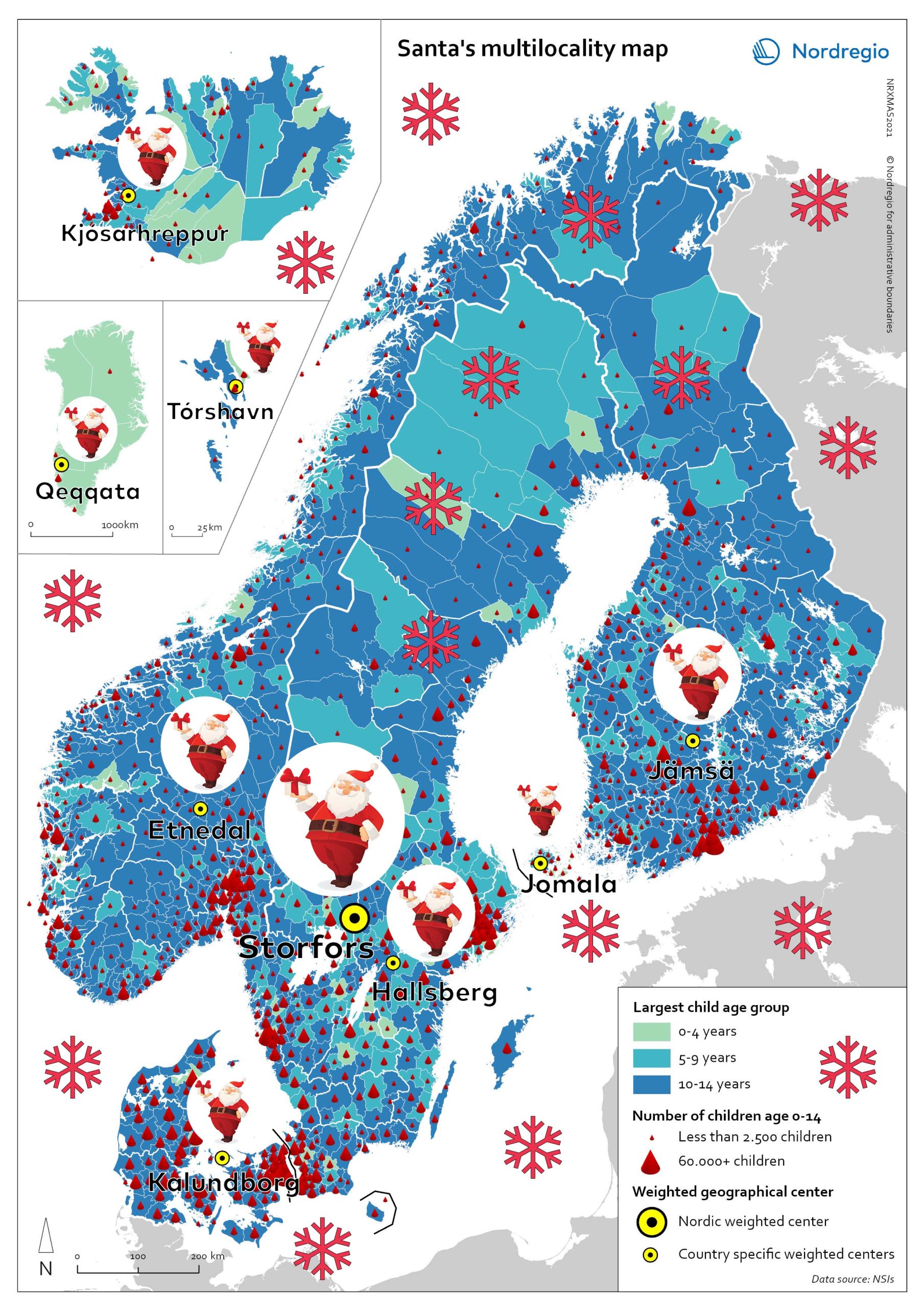

Help Santa to work remotely – where to locate in 2021?

Help Santa! To reduce his transit times and emissions – reindeers burn a lot of (green) fuel – and find an optimal remote workplace from where to deliver gifts to all the children in the Nordic Region! Santa has heard about this new trend “multilocational lifestyle” and he would like to know if this would suit him as well. But where to move? Santa’s little researchers have worked hard this year and done some mapping for him – and discovered places you have never even heard of! If Santa is to serve all children (0-14 years old) throughout the Nordic Region from a single address, the solution lies in Storfors Municipality. WHERE? – you might think. It is a real place, in Central-Southern Sweden. Here Santa has an average distance of 425 km distance to each child from his own backyard. This still sounds like awfully many kilometers. Could he be even more multilocal – with a home in each of the Nordic countries? This would help him to reduce his overall commuting to work significantly. Let’s try it! If he serves all 4.974 children in Åland from a residence (like a luxury hotel with all-inclusive and pets allowed) in Jomala Municipality, he will only have to travel 11 km to work on average. In Greenland, the distances are somewhat larger, and Santa, even with the most optimal location from a residence (a cabin) in Qeqqata Municipality would have to travel 288 km to each of the 11,748 children in the country. Can you guess what the other optimal locations would be in the Nordics? I bet you can’t so I will tell you: it’s the municipalities of Hallsberg in Sweden, Jämsä in Finland, Etnedal in Norway, Kalundborg in Denmark, Kjósarhreppur in Iceland and Tórshavn in Faroe Islands. Well, Santa…

2021 December

- Nordic Region

- Others