Income inequality has increased more in the Nordic countries than in most OECD countries since the early 1990’s. The starting point, however, was exceptionally low, and inequality in the region remains well below the OECD average. Capital income has become a more significant factor of inequality, partly because two-thirds of all dividends go to the top one per cent, and redistribution has weakened, thus contributing to the trend. Income inequality is the topic of the Nordic Economy Policy Review 2018, published by the Nordic Council of Ministers.

International trend of increasing inequality

Lars Calmfors, Professor Emeritus of International Economics at Stockholm University and researcher at the Research Institute for Industrial Economics is chief editor of the Nordic Economy Policy Review 2018 (NEPR). He explains that the widening income distribution has been a topic of great interest in both public debate and economic research in recent years all around the world. NEPR sheds light on developments of income inequality in Denmark, Finland, Norway and Sweden, and discusses some of the key contributing factors to the growing income disparities.

“Income inequality is increasing in most advanced economies,” Calmfors says. “While the Nordic countries started from a very compressed income distribution in the early 1990’s, the region is part of this international trend. Over the past twenty years, we’ve seen considerable change, especially in Sweden and Finland.”

The contributions in this year’s issue of the NEPR include inter alia an analysis of the Nordics from an international perspective, a study of the increased income share going to top earners, which also explores the role of capital income, and a paper on the gender dimension of income inequality.

Larger share of total income goes to top earners

One of the overall trends is the growing income share going to top earners, which has contributed significantly to the rising income inequality in the region. Roughly one-third of the overall increase over the last two decades can be attributed to this development. Capital income, i.e. interest income and dividends, has become increasingly important. Due to the more unequal distribution of such income, favouring top income groups, this strengthens the trend to larger income disparities.

“It’s striking to see the sizeable share of total capital income that goes to the top-one per cent,” says Jakob Søgaard, Postdoc at the Department of Economics at the University of Copenhagen and author of Top incomes in Scandinavia – recent developments and the role of capital income. “We found that interest income is actually not that unevenly distributed – the top one per cent receives around ten per cent of interest income. The difference is much more distinct when it comes to dividends, as around two-thirds of all dividends go to the top one per cent.”

“We’ve seen a shift in the composition of capital income in the household sector, away from interests and toward dividends,” Søgaard says. “This is a likely explanation of a substantial part of the rise in the top income share. In fact, the dividends as a share of total household income and the top income share follow each other closely across all four countries.”

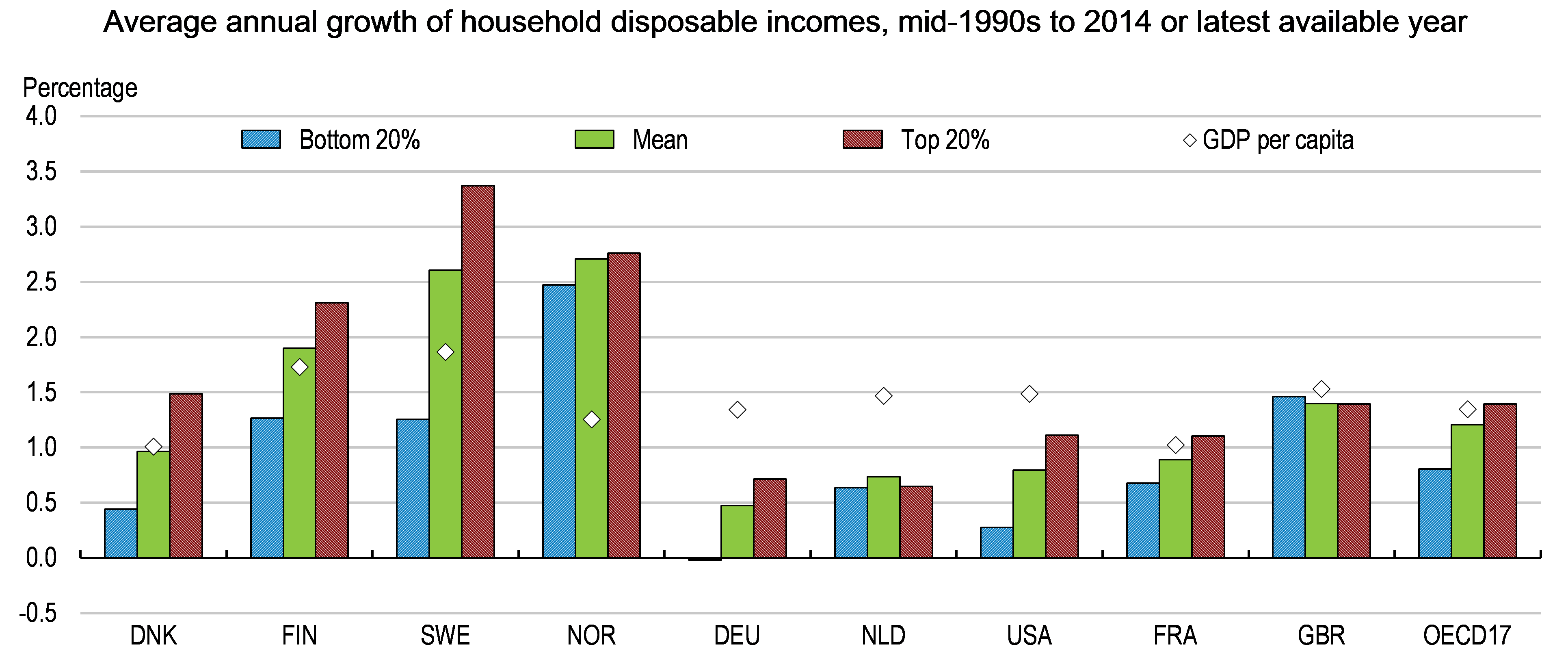

Inequality has increased in the Nordics, but incomes have risen across the distribution. Based on equivalised household disposable incomes, deflated by consumer price indices. OECD17 is a simple average across 17 OECD countries. Data refer to 1994-2014 for the United Kingdom; 1995-2015 for Finland, the Netherlands and the United States; 1996-2014 for France; and 1995-2014 for the rest. Divergences between the evolution of GDP per capita and household incomes, as observed here, may occur for a number of reasons (for details, see e.g. OECD 2016a and Noland et al. forthcoming). Source: OECD Income Distribution Database.

Weakened redistribution is a key factor

According to Calmfors, increased income disparities in Anglo-Saxon countries are mostly related to increasing wage dispersion, often linked to globalisation and technological change favouring high-skilled workers.

“The impact of skilled-biased technological trends and globalisation has been relatively limited in the Nordic region,” says Jon Pareliussen, Economist at the OECD and main author of Income inequality in the Nordics from an OECD perspective. “This is mainly because of the set of policies and institutions often referred to as the Nordic model – i.e. strong unions that counteract the widening of the wage distribution, free education, which reduces the skills premium in the Nordic countries, and of course the whole tax take and public sector that finance the generous welfare services.”

“Here, the rising income inequality is more connected to weakened redistribution,” says Calmfors “The Pareliussen et al. paper has identified what seems to be a general trend in the Nordics – that redistributive cash transfers, notably unemployment and sickness benefits, play a less redistributive role than earlier.”

When drawing conclusions from the data, says Pareliussen, it is important to keep in mind that income inequality in the Nordic countries was low in the late 1970’s to early 1990’s, while the degree of redistribution was high.

“At these high levels, redistribution reduced work incentives, was expensive for the government and perhaps had a negative impact on economic efficiency,” he explains. “Since then, in particular unemployment insurance has been reduced. One could argue that by creating stronger work incentives, these reductions may have contributed to positive employment developments.”

Changes in household structure affect income inequality

Pareliussen and his co-authors identified changes in household structure as the most important demographic factor affecting income inequality in the region. Aging populations and immigration also tend to increase inequality, but to a lesser degree, the analysis shows.

“There has been a large increase in the number of single-person households, which typically have lower incomes,” Pareliussen says. “In Denmark, for instance, the increasing number of student households explains much of the rise in income inequality and the increase in the poverty rate.”

A menu of policy options

In the introduction to the NEPR 2018, Calmfors and his co-editor, Jesper Roine, draw six possible policy conclusions based on the analysis in the volume.

“It’s important that the debate on income inequality accommodates different political preferences and value judgements,” says Calmfors. “In our conclusions, we therefore do not take a stand on whether income inequality should be reduced, but rather outline a number of policies that can be useful if the objective is to reduce income disparities.”

“As an example, if you prioritize a more equitable income distribution, it’s not a good idea to introduce user charges for welfare services provided by the government. It is also important to uprate cash benefits in line with wages, which has not been done over recent decades. And if the ambition is to counter the rising top-income share, policy makers can restrict the possibilities to convert highly taxed labour income to lower taxed capital income via closely held companies, they can raise real estate taxes, which are low in all the Nordic countries, and increase or reintroduce inheritance and wealth taxes.”

“We’ve provided a menu of options for the policy makers, if you like.”