108 Maps

Regional Potential Index 2022

This map shows the result of Nordregio’s Regional Potential Index in 2024 (data from 2022). Nordregio’s Regional Potential Index (RPI) enables cross-regional comparison of development potential and illustrates the regional balance between the Nordic countries and has been part of the State of the Nordic Region report since 2018. The purpose of this multidimensional index is to summarise the current and past performance of the Nordic regions across major policy domains. The index helps to identify regions that have high potential and those in need of further support to boost their potential and meet existing challenges. It provides policy-makers with a comparative learning tool that informs the design of effective regional development strategies at Nordic level. Nordregio’s RPI is a multi-item measurement scale that incorporates information about the demographics, labour market and economic output of the Nordic countries’ 66 administrative regions. It consists of eight indicators classified into four main groups and eight subgroups. These components and indicators were originally selected on the basis of their relevance for regional development. The 2024 RPI is based on a new refined method that maintains a similar set of indicators but applies a more robust statistical process to the construction of the RPI. In brief, the new methodology consists of a pre-processing stage, in which the input data is prepared for analysis, and a processing stage, in which the indicators are weighted and aggregated. More information about the method can be found in the State of the Nordic Region 2024 report. The RPI was calculated retroactively for the 2015–2023 period. However, the focus in this section is on 2022 – the most recent year in our time series with full data coverage. The map shows the redesigned RPI for that period. In line with the principles of accumulation and agglomeration that drive the…

2025 April

- Demography

- Economy

- Labour force

- Nordic Region

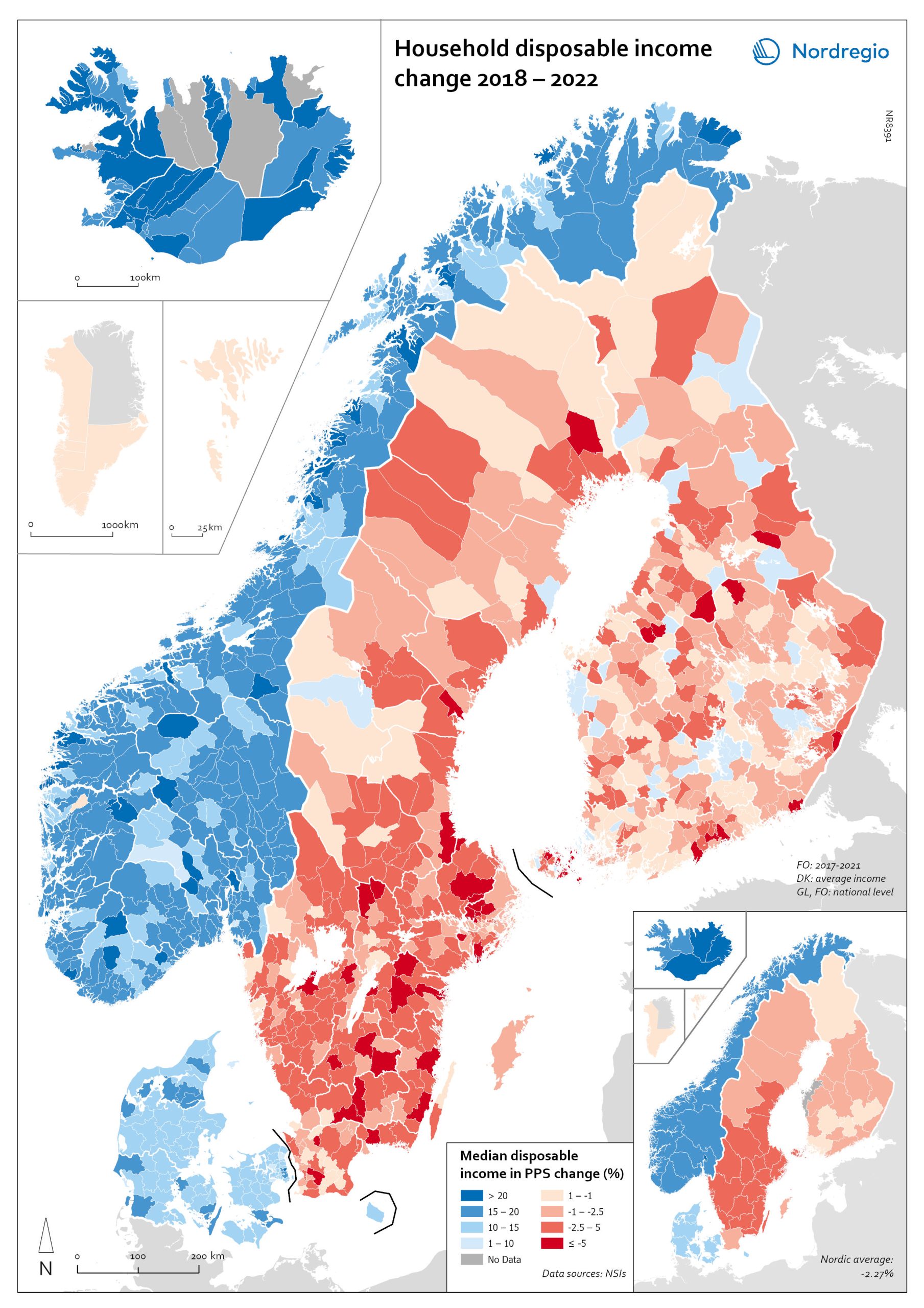

Household disposable income change 2018-2022

This map shows the percentage change in household disposable income between 2018 and 2022 in Nordic municipalities (big map) and regions (small map). Household disposable income per capita is a common indicator of the affluence of households and, therefore, of the material quality of life. It reflects the income generated by production, measured as GDP that remains in the regions and is financially available to households, excluding those parts of GDP retained by corporations and government. In sum, household disposable income is what households have available for spending and saving after taxes and transfers. It is ‘equivalised’ – adjusted for household size and composition – to enable comparison across all households. Purchasing Power Standards (PPS) is used to compare the countries’ economies and the cost of living for households. As shown in the map, between 2018 and 2022, household disposable income increased for all Danish, Icelandic, and Norwegian municipalities and decreased for Finnish and Swedish municipalities. On average, the city municipalities have higher incomes and increased most in Finland and Sweden in 2018–2022. In Sweden, a tendency towards larger falls in income was observed in several southern municipalities. In summary, absolute household income increased in all Nordic countries but not when measured in purchasing power. Based on this metric, on average, Norwegian households are the most well-off and Iceland the worst off, while Danish households benefited from a stronger currency in 2022. Single-parent households have had lower increases in household income than other families in Norway and parts of Sweden. Municipalities show a similar trend in Norway and Denmark, although Norwegian coastal municipalities fared slightly better in 2022. Disposable income is falling in all Swedish and Finnish municipalities.

2025 April

- Economy

- Nordic Region

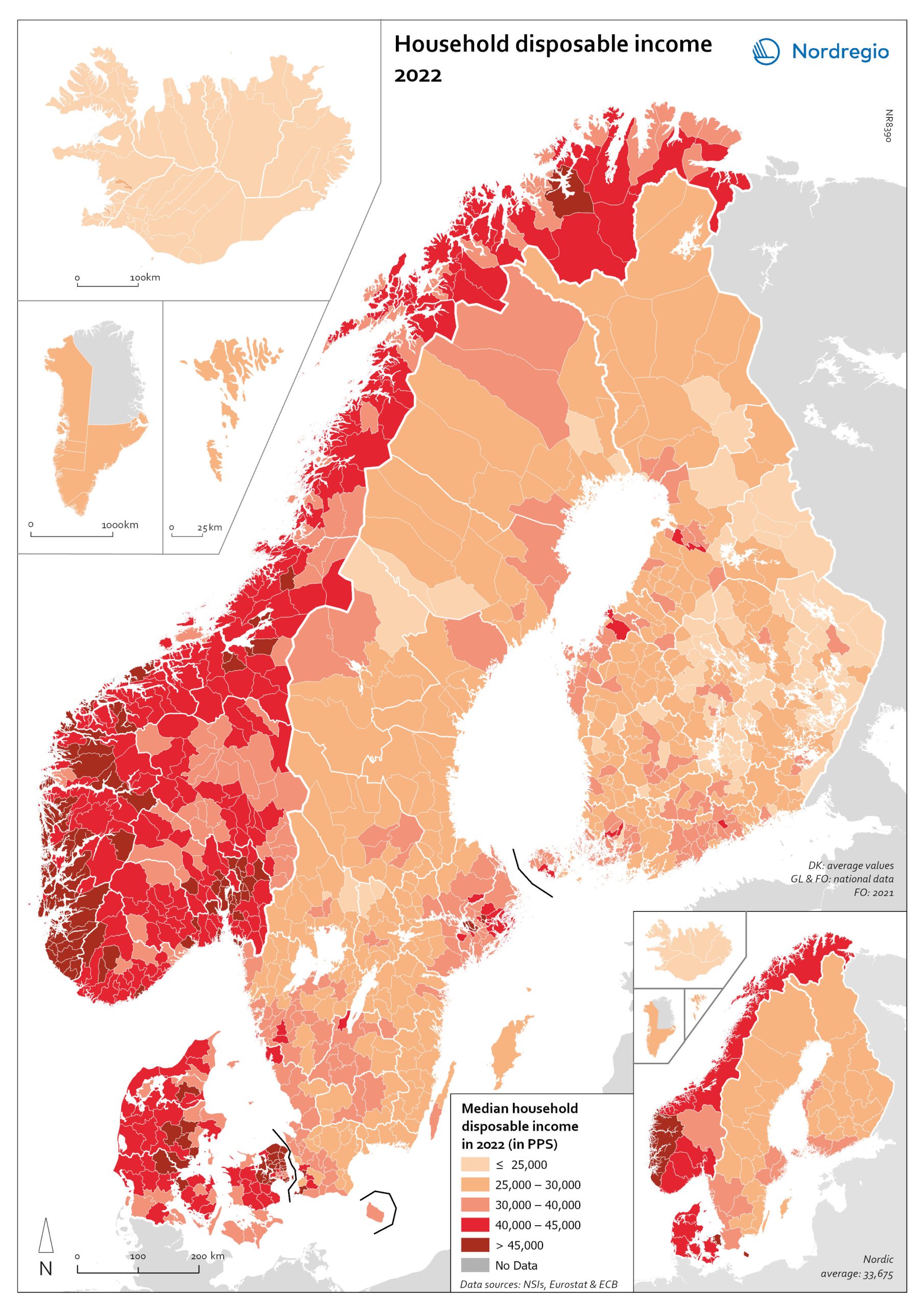

Household disposable income 2022

This map shows the median household disposiable income measured in purchasing power standard (PPS) in Nordic municipalities (big map) and regions (small map) in 2022. Household disposable income per capita is a common indicator of the affluence of households and, therefore, of the material quality of life. It reflects the income generated by production, measured as GDP that remains in the regions and is financially available to households, excluding those parts of GDP retained by corporations and government. In sum, household disposable income is what households have available for spending and saving after taxes and transfers. It is ‘equivalised’ – adjusted for household size and composition – to enable comparison across all households. Purchasing Power Standards (PPS) is used to compare the countries’ economies and the cost of living for households. The map shows the intra-municipal differences in household disposable income in PPS, which reveals the different patterns in the Nordic countries. Norwegian coastal municipalities have slightly higher household disposable income than inland municipalities, with some exceptions. Finnish, Icelandic, and Swedish municipalities generally have much lower household disposable income compared to Norwegian and Danish municipalities, except for the larger urban areas. In Denmark, most municipalities are at a similarly high level, except for remote islands in the south. The differences between the Icelandic municipalities are rather small, at a medium to lower level.

2025 April

- Economy

- Nordic Region

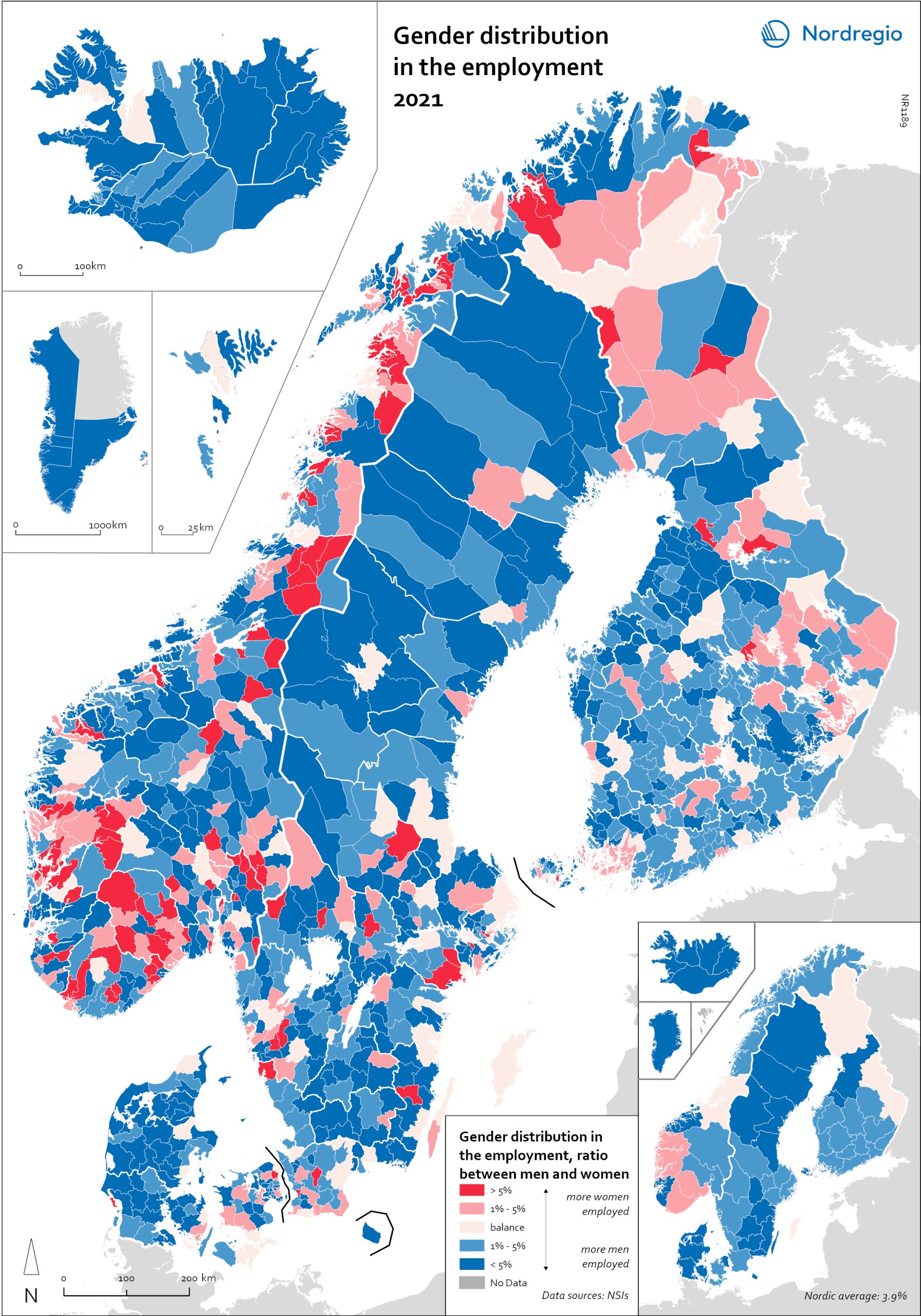

Gender distribution in employment 2021

This maps shows the gender distribution in employment at both municipal (big map) and regional levels (small map) in the Nordic Region in 2021 (measured in November). Blue shades indicate more men employed and red shades more women. Most regions had higher employment rates for men than women, with an average of 3.7% more men across the countries and sectors. In Finland, the rates were more balanced, with only 1.3% more men in employment. In three regions in Finland, employment rates were slightly higher for women: Etelä-Karjala – Södra Karelen, with 0.8% more women than men; Kainuu – Kajanaland, with 0.4%; and Uusimaa – Nyland with 0.1%. These are the only regions in the Nordic countries with a prevalence of employed women at the regional level. For the rest, employment rates were higher for men, with Icelandic regions having the largest share: Suðurnes had 11.3% more men than women, Vesturland 8.8%, Austurland 8.7%, and Suðurland 8.2%. The average for the Icelandic regions was 7.5%. For Denmark, this was 4.9%, for Sweden, 3.9%, and for Norway, 3.4%. At the municipal level, however, the situation was much more varied. Åland is one of the most extreme examples. Although the average was 2.5% more men employed than women, Åland has several municipalities with extremes at both ends. On the one hand, there are municipalities like Lumparland, with 16% more women than men, and Brändö, with 11.3%. On the other hand, Kökar had 64% more men than women. The variations between Ålandic municipalities can largely be attributed to the municipalities’ population size. The larger cities, like Trøndelag in Norway, may be more balanced at the regional level, but within the region, there are municipalities with a 20% prevalence of women in employment (Namsskogan, Meråker, Holtålen), as well as some with 18% (or higher) more…

2025 April

- Economy

- Labour force

- Nordic Region

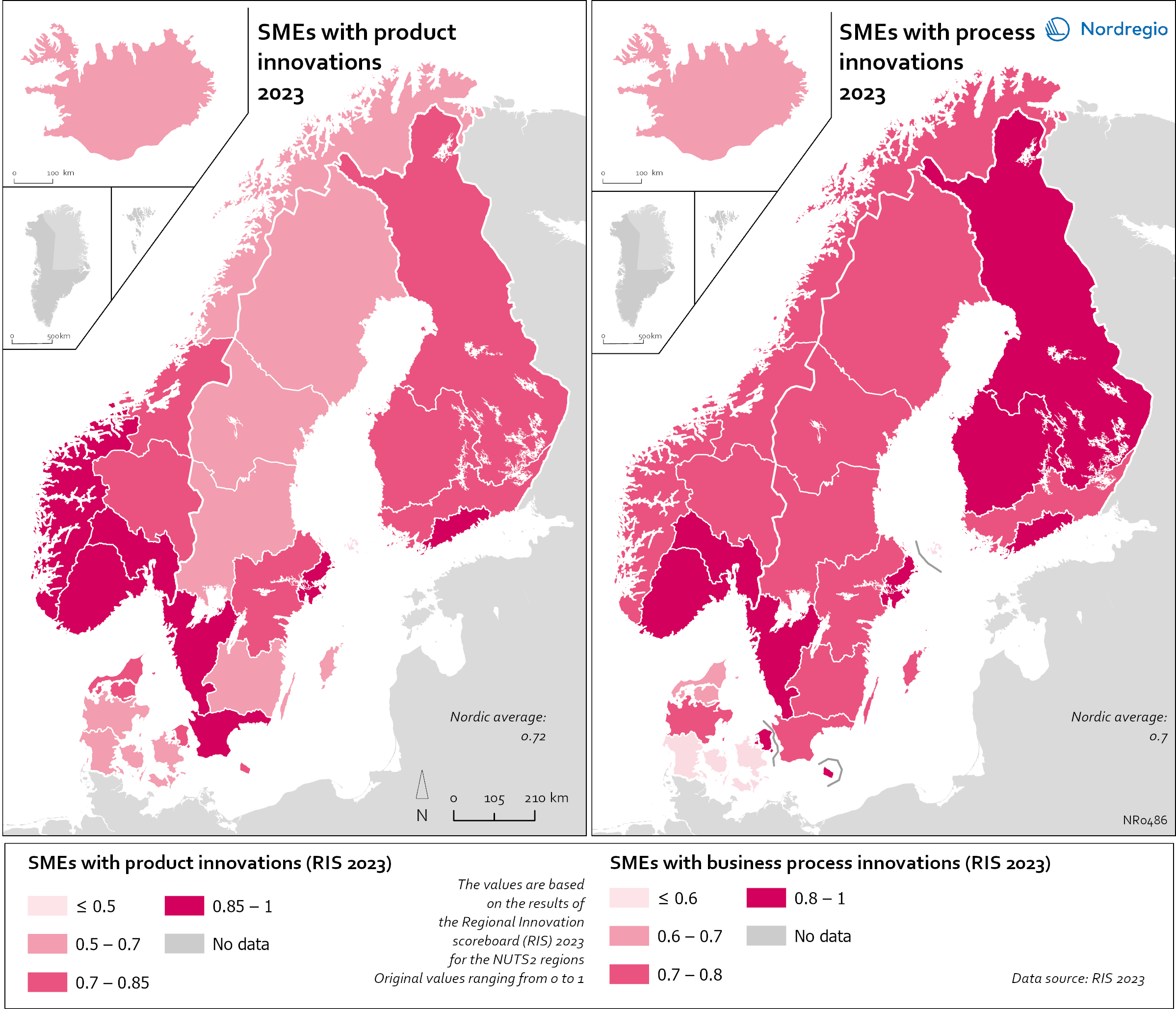

Small and Medium Sized Enterprises (SMEs) with product and business process innovation in 2023

These maps depicts Small and medium sized enterprises (SMEs) with product innovation (left map) and process innovation (right map) in 2023. The data is displayed at the NUTS2 level and the data comes from the Regional Innovation Scoreboard 2023. The left map depicts SMEs introducing product innovations as a percentage of SMEs in the Nordic regions, calculated as the share of SMEs who introduced at least one product innovation. The values for the map are normalised from 0–10. In this context, a product innovation is defined as the market introduction of a good or service that is new or significantly improved with respect to its capabilities, user-friendliness, components, or sub-systems. Rural regions tend to have lower levels of SMEs with product innovations, while urban regions have the highest levels. In 2023, Åland (0.235) had the lowest number of SMEs with product innovations in the Nordic Region, while Oslo had the highest (1.0). Etelä-Suomi and Stockholm regions were slightly behind, with 0.954 and 0.948, respectively. In Denmark, the leading regions were the Capital Region (Hovedstaden) and Northern Jutland (Nordjylland), with 0.719 and 0.715, respectively. Southern Denmark (Syddanmark) had the lowest level in Denmark, at 0.545. In Norway, the lowest value was in Northern Norway (Nord-Norge), 0.67, while in Sweden it was Middle Norrland (Mellersta Norrland), with 0.53. Taken as an average across the Nordic countries, Norway has a significantly higher number of SMEs with product innovations than the other countries. The right map shows the share of SMEs introducing at least one business-process innovation, which includes process, marketing, and organisational innovations. In general, Nordic SMEs are more likely to innovate in products rather than processes. The highest shares of process-innovating SMEs are found in most of the Finnish regions ranging from 0,79 in Länsi-Suomi to 0,91 in Etelä-Suomi, except of Åland…

2025 April

- Economy

- Nordic Region

- Research and innovation

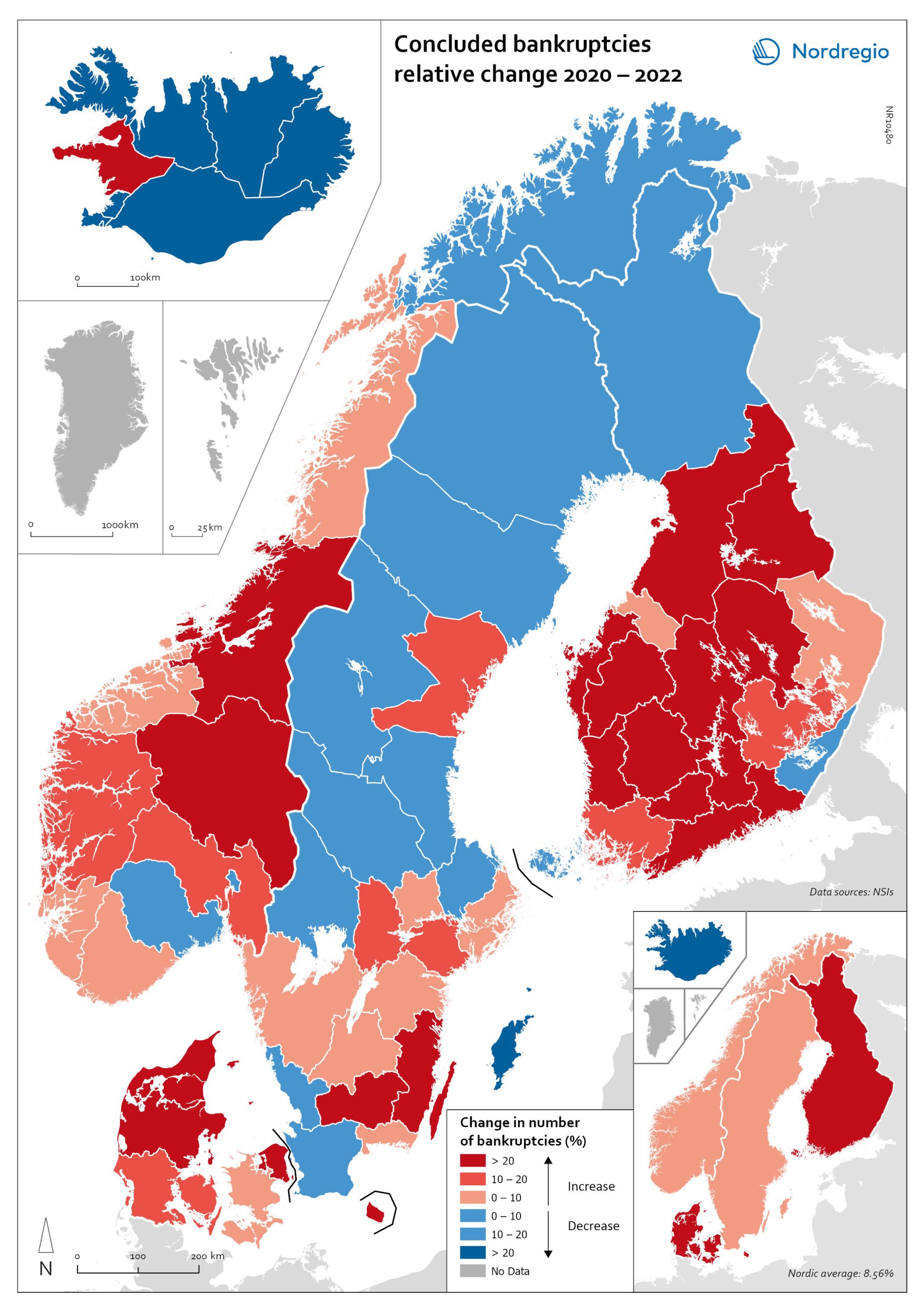

Change in the number of business bankruptcies (2020–2022)

This map depicts the change in total number of bankruptcies in the Nordic regions between 2020 and 2022. The red shades indicates an increase in numbers of bunkruptcies and blue shades a decrease. The big map shows the regional level and the small map the national level. The rate of business bankruptcies is a core indicator of the robustness of the economy from the business perspective. Nordic and international businesses have been impacted by both the COVID-19 pandemic and rising inflation in recent years. In terms of the level of bankruptcies, data from Eurostat (2024) shows that the Nordic countries fared relatively well compared to other high-income countries between 2020 – 2022. In the years during and after the COVID-19 pandemic, the most densely populated regions saw the highest levels of bankruptcies. This finding is partly to be expected, as these regions also tend to be those with the highest number of companies. However, some variation can be seen across the countries. Overall, Iceland and Finland experienced the lowest rate of bankruptcies in 2020 and 2022. Denmark had the highest level of bankruptcies during COVID-19. Potential explanations for the national variations may include the countries’ varying strategic approaches to the pandemic. Denmark enforced more restrictive lockdowns compared to, for example, Sweden, where the less restrictive approach has been linked to the more limited impact on business bankruptcies in the early part of the pandemic. Furthermore, there is a large consensus that the many jobretention schemes across the Nordic Region also served to limit the number of bankruptcies. However, new data from early 2024 shows that after the job-retention schemes ended, and while high inflation and interest rates were increasing the pressure on Nordic companies, the level of bankruptcies increased. In 2023, 8,868 companies went bankrupt in Sweden the highest number…

2025 April

- Economy

- Nordic Region

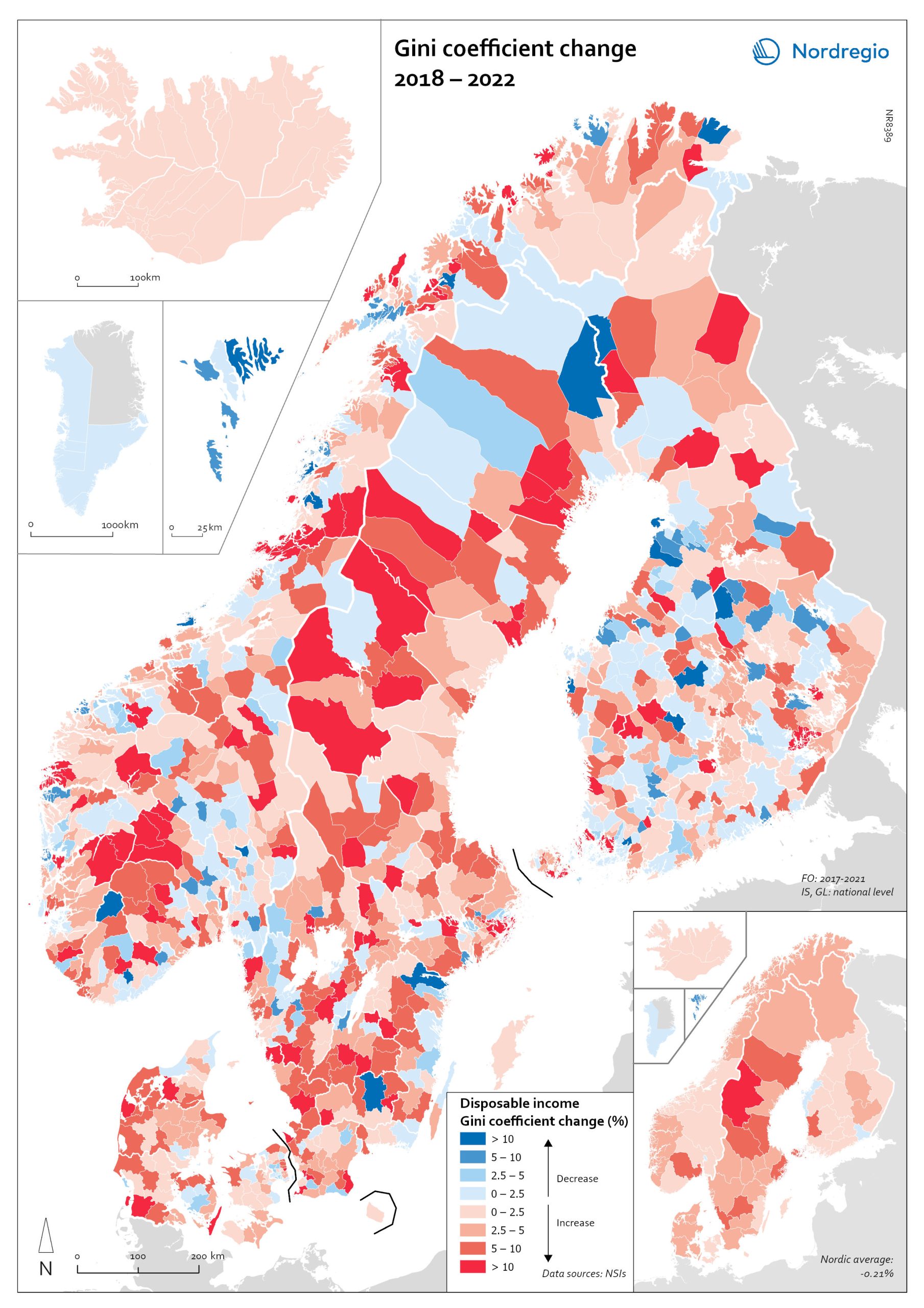

Gini coefficient change 2018-2022

This map shows the percentage change in the Gini coefficient between 2018 and 2022. The big map shows the change on municipal level and the big map at regional level. Blue shades indicate a decrease in income inequality, while red areas indicate an increase in income inequality The Gini coefficient index is one of the most widely used inequality measures. The index ranges from 0–1, where 0 indicates a society where everyone receives the same income, and 1 is the highest level of inequality, where one individual or group possesses all the resources in the society, and the rest of the population has nothing. The map illustrates significant variations in the change in income inequality across Nordic municipalities and regions. Between 2018 and 2022, income inequality increased in predominantly rural municipalities, notably in Jämtland, Gävleborg, Dalarna and Västerbotten in Sweden, as well as Telemark in Norway. For Denmark, the rise in inequality is mainly for the municipalities in Western Jutland. At the same time, approximately one third of municipalities in the Nordic Region experienced a decrease in income inequality during the same period, primarily in Finland and Åland. For example, in Finland, the distribution of inequality was more varied. This trend aligns with the ongoing narrowing of the household income gap observed in many Finnish municipalities since 2011, which is mainly attributed to the economic downturn of the early 2010s, as well as demographic shifts such as outmigration and ageing.

2025 April

- Economy

- Nordic Region

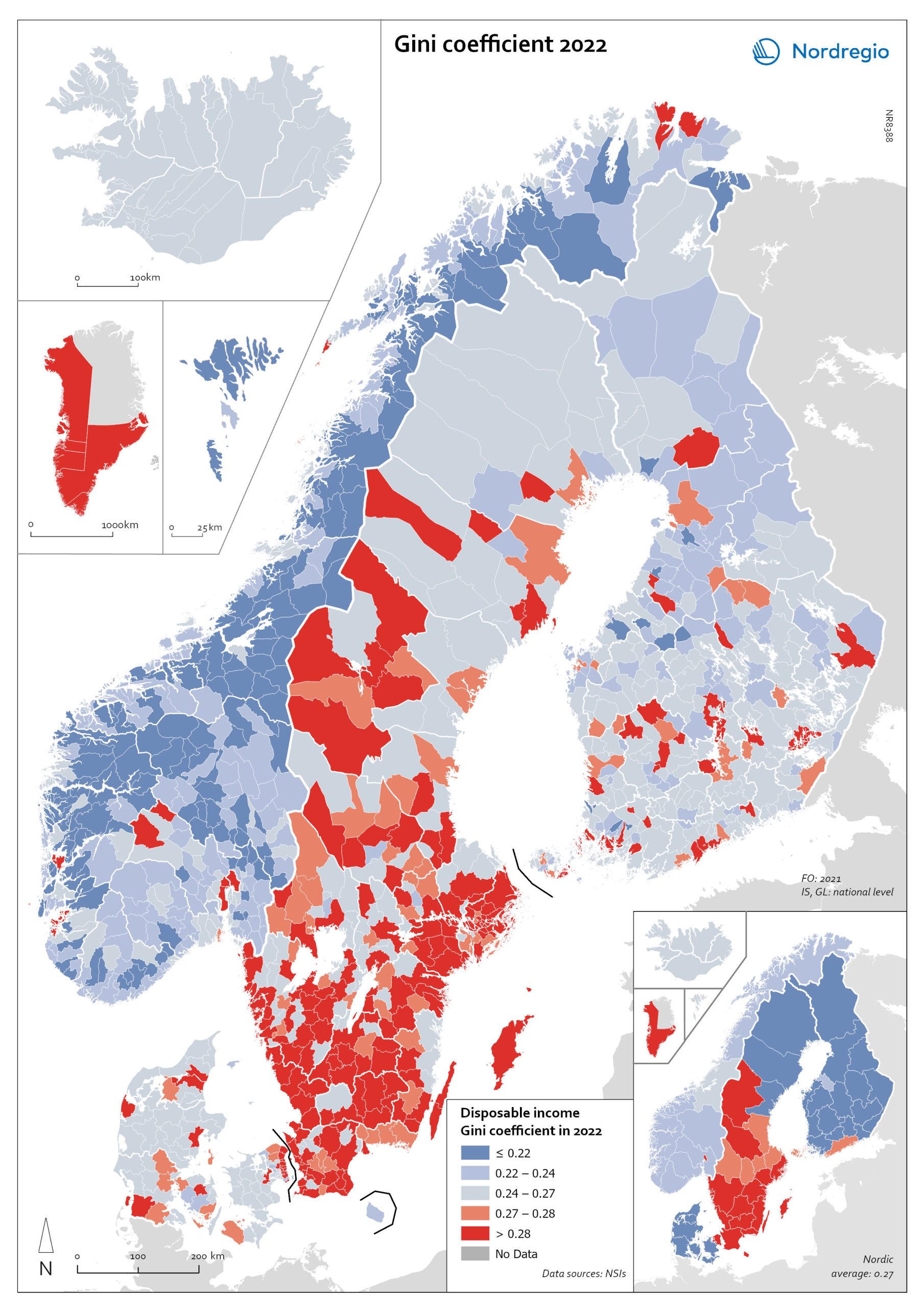

Gini coefficient for disposable income in 2022

This map shows the Gini coefficient in Nordic municipalities (big map) and regions (small map) in 2022 (no data was available for Iceland). Blue shades indicate a Gini coefficient below the Nordic average. Red areas indicate a Gini coefficient above the Nordic average (0.27, excluding Greenland, as a statistical outlier). The data for the Faroe Islands is for 2021. The Gini coefficient index is one of the most widely used inequality measures. The index ranges from 0–1, where 0 indicates a society where everyone receives the same income, and 1 is the highest level of inequality, where one individual or group possesses all the resources in the society, and the rest of the population has nothing. In 2022, the highest municipality income disparities were observed in the capital city regions of Denmark, Finland and Sweden, each of which had Gini coefficients around 0.6. Danderyd (0.64), Lidingö (0.52), and Gentofte (0.51) had the highest Gini coefficients. These municipalities also have some of the highest incomes in their respective countries.

2025 April

- Economy

- Nordic Region

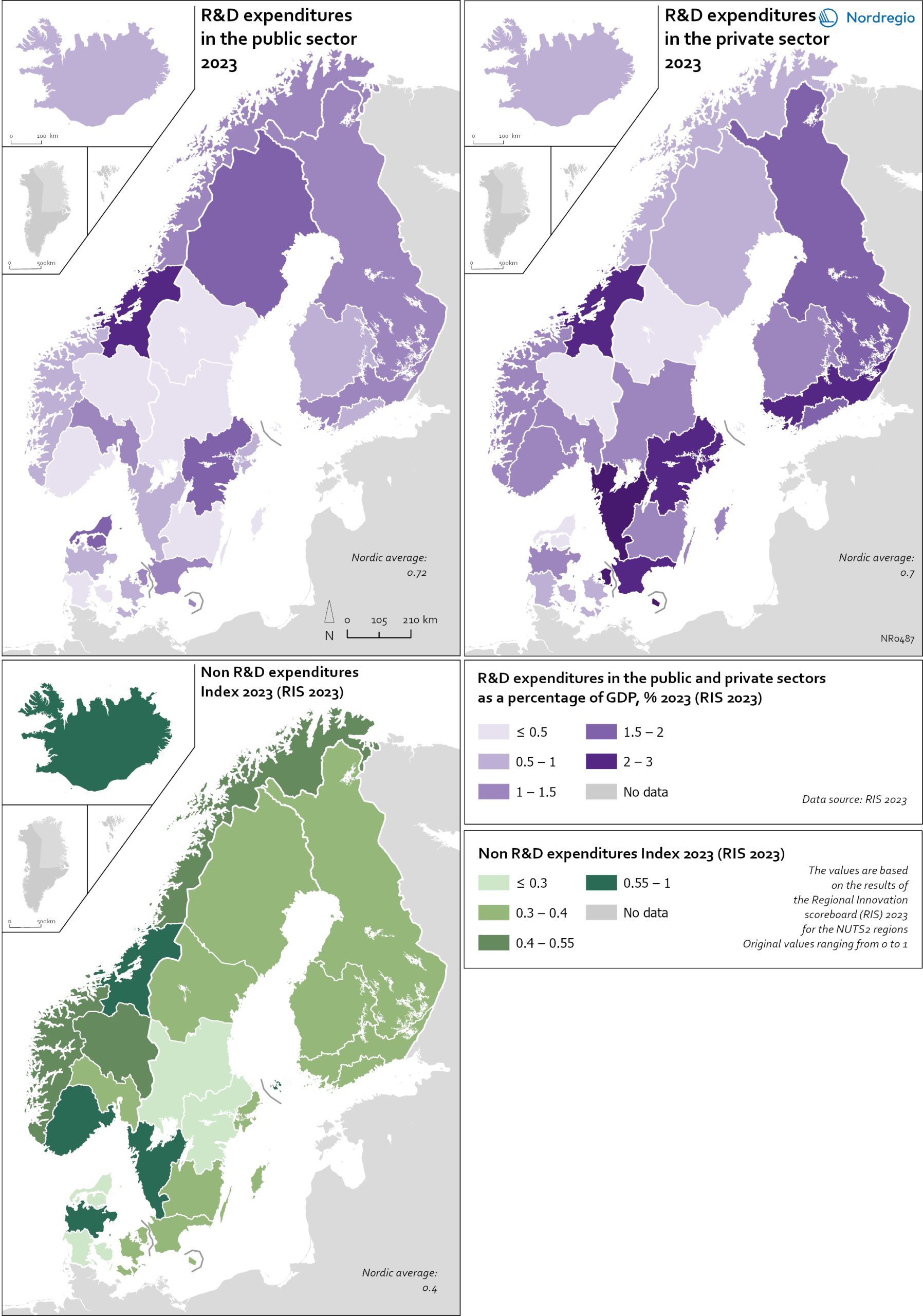

R&D and non-R&D expenditures in the public and private sector

These maps shows the expenditure on Research and Development (R&D) in the public and business sectors as a percentage of regional GDP, along with non-R&D innovation expenditure in Small and Medium Enterprises (SMEs) as a percentage of turnover. Together, these metrics offer a comprehensive understanding of the innovation landscape and provide insights into governments’ and higher education institutions’ commitment to foundational research, as well as the competitiveness and dynamism of the business environment and SMEs’ innovation capacity. By considering investment in both R&D and non-R&D activities, these indicators illustrate a broad spectrum of innovation drivers, from basic research to market-driven initiatives, and underscore the diverse pathways through which innovation fosters economic growth and social progress First, the top left map showcases R&D expenditure in the public sector as a percentage of GDP in the Nordic countries in 2023. In that year, the European level of R&D expenditure in the public sector, as a percentage of GDP, was 0.78%. By comparison, the Nordic average was 0.9%. While the more urban regions, in general, lead the Nordic regions, this is not always the case, as shown by the variation between the frontrunners. The leading region is Trøndelag (including Norway’s third-largest city, Trondheim), with 2.30% of regional GDP. It is in third place in the EU as a whole. The next regions are Övre Norrland with 1.77%, Northern Jutland with 1.54%, Östra Mellansverige with 1.52%, and Hovedstaden with 1.49%. A common feature of most of the top-ranking regions is that they host universities and other higher education institutions known for innovation practices. Most Nordic regions have not seen significant increases or decreases in public R&D spending between 2016 and 2023. The top right map focuses on the private sector’s investment in research and development activities and depicts R&D expenditure in the business sector…

2025 April

- Economy

- Nordic Region

- Research and innovation

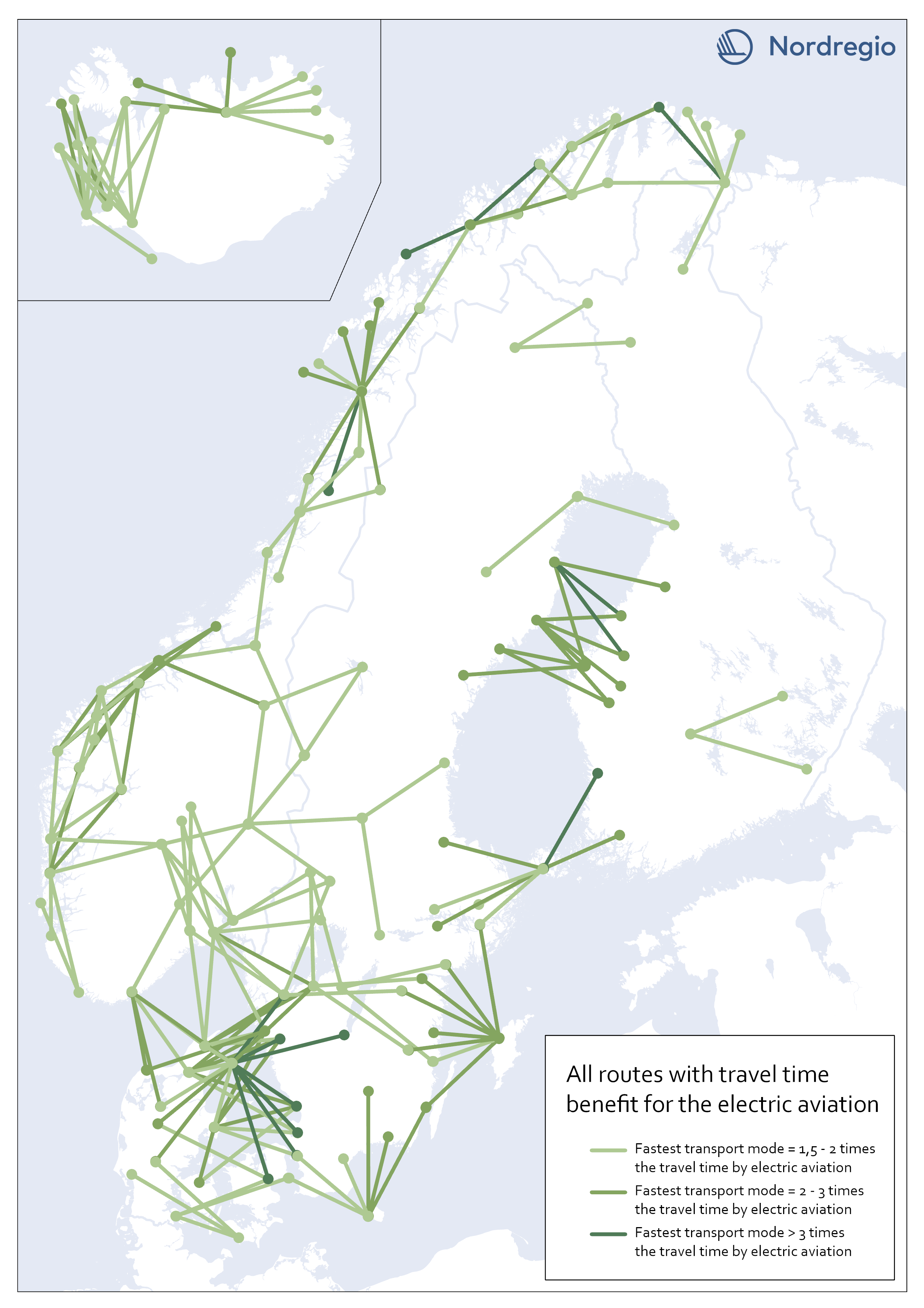

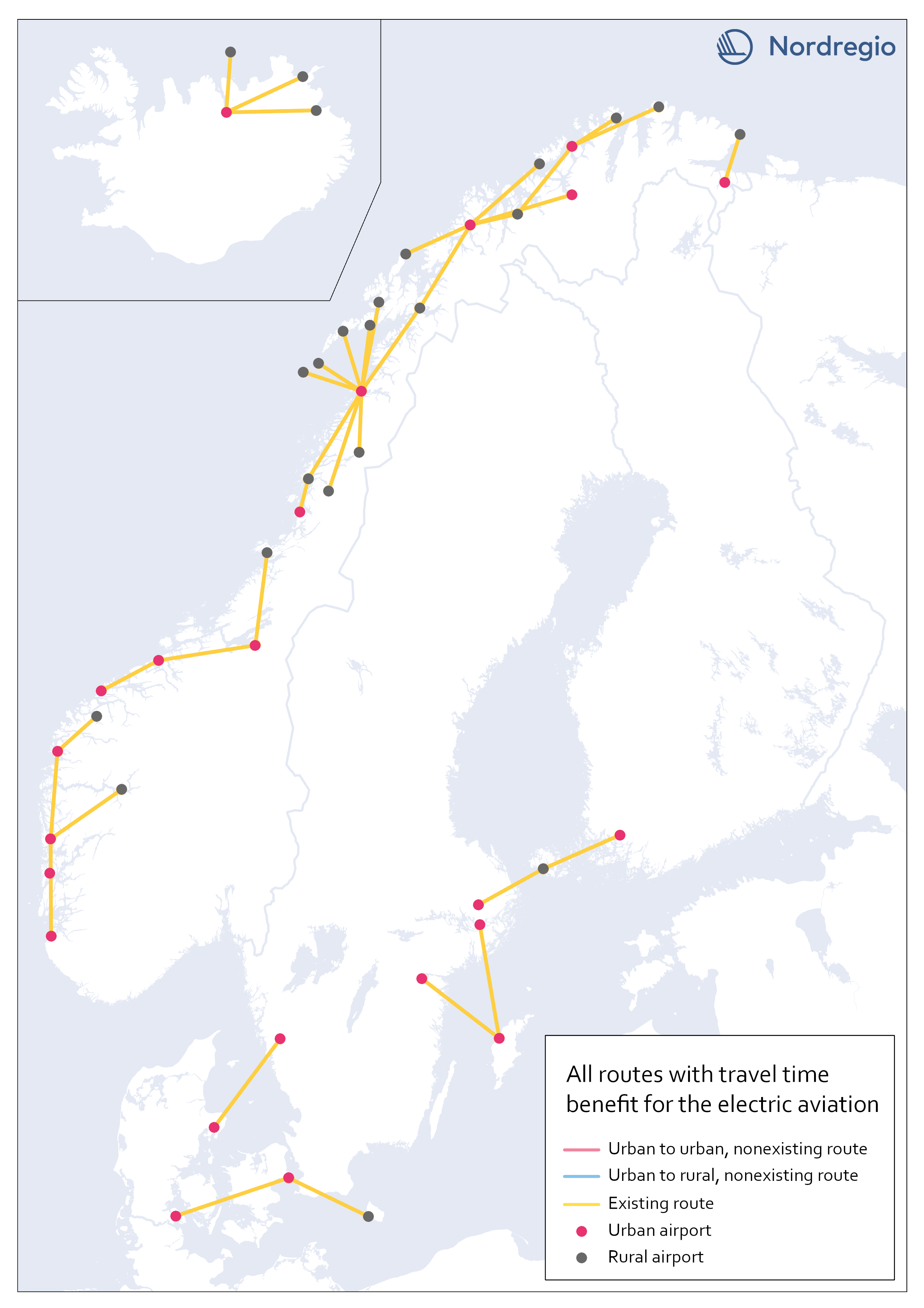

All routes with time benefit for electric aviation

The map shows all routes in our sample with significant travel time benefit for electric aviation. They are 203 in total. A route has a significant travel time benefit if the travel time for both car and public transportation exceeded 1,5 times the travel time for electric aviation. I.e., if one of the existing transport modes is faster or up to 1,5 times the travel time for electric aviation, electric aviation does not have the potential to improve accessibility between the two destinations, according to our analysis.

2023 February

- Nordic Region

- Transport

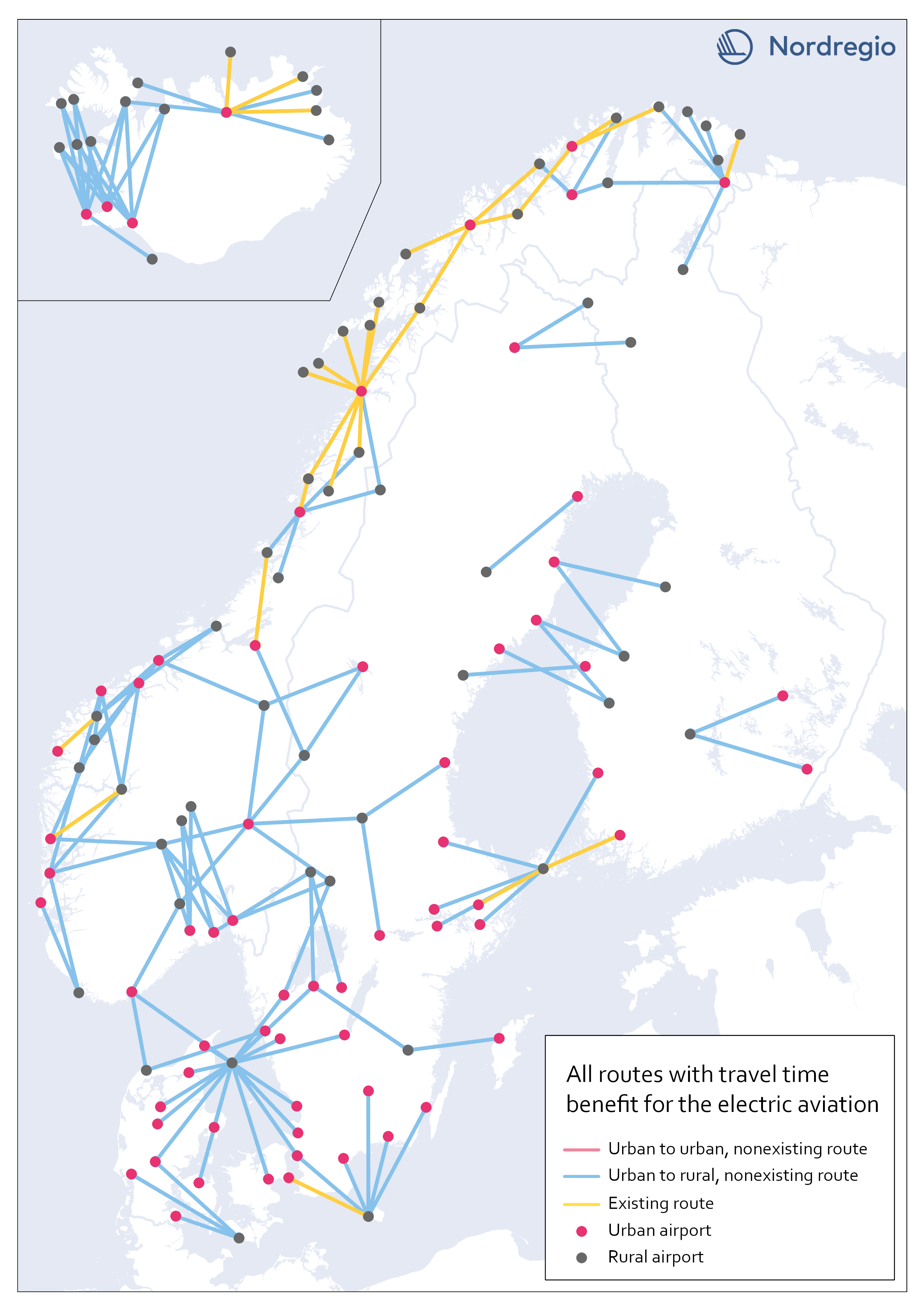

Electric aviation time benefits between urban and rural areas

The map shows all routes between urban and rural areas where electric aviation has significant time benefits compared to other traffic modes. Yellow lines are already served by aviation, while blue color indicates non-existent routes where electric flight would reduce the travel time between destinations. Our motivation for focusing on urban-rural routes was based on the assumption that electric aviation can increase the access for rural areas to public facilities and job opportunities, as well as the possibility of connecting remote areas with national and international transport systems. The result, though, can only be understood in terms of travel time benefits between the areas, and thus reveals little about accessibility to mentioned opportunities. The following are examples of themes to be investigated further within the main project. Identify regional hubs Among others, the project FAIR (2022) has addressed the need to update the flight system to a more flexible aviation network, that meet travelers’ needs with smart mobility. This can be done by identifying demands and establishing regional hubs for electric aviation, which can serve remote and regional areas. The potential of Hamar and Bodö in Norway as regional hubs should be studied more closely.

2023 January

- Nordic Region

- Transport

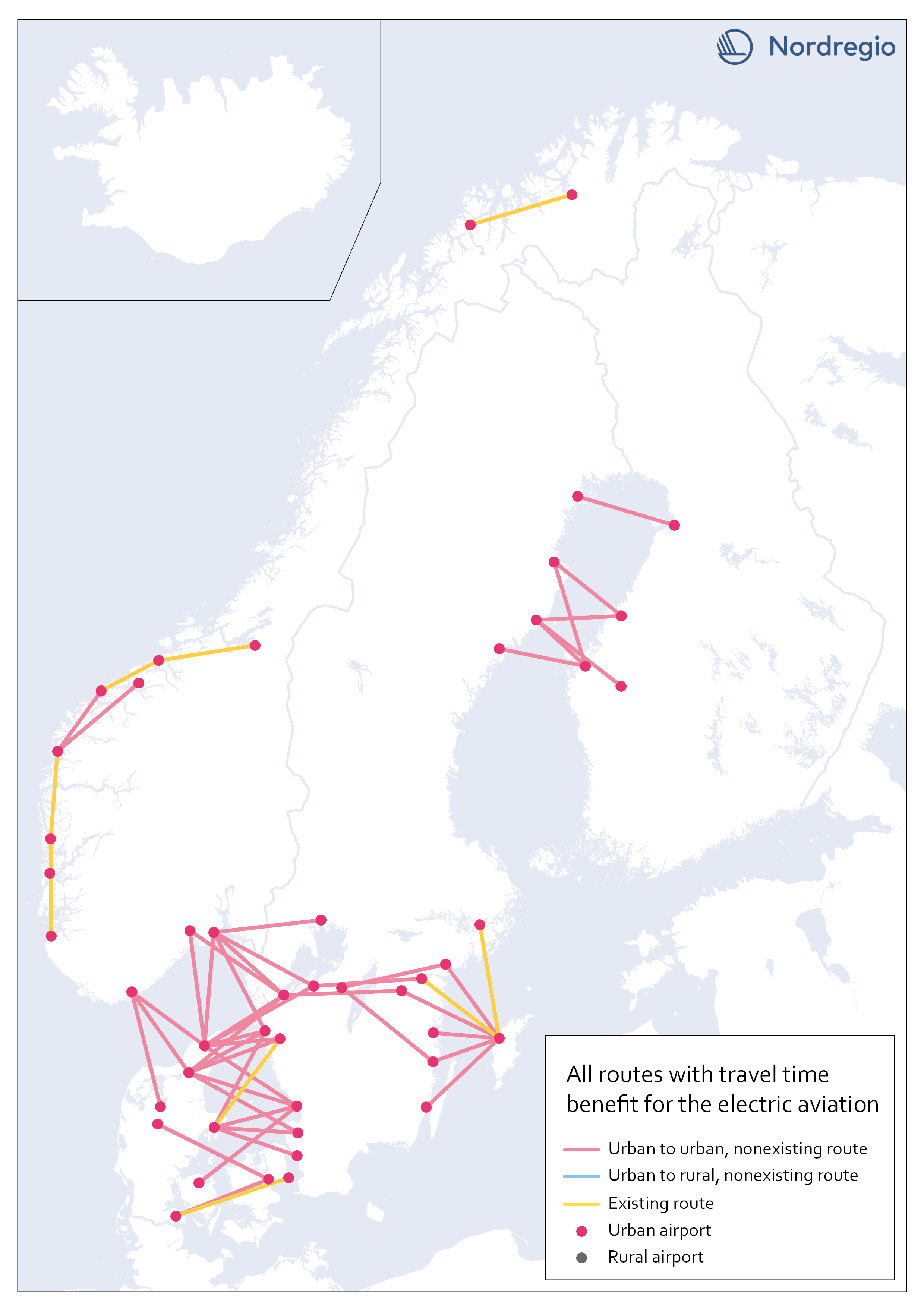

Electric aviation time benefits between urban areas separated by water

The map shows all routes between urban areas separated by water, and where electric aviation has significant time benefits compared to the fastest traffic mode. Yellow lines are already served by aviation, while red color indicates non-existent routes where electric flight would reduce the travel time between destinations. The result is in line with our assumptions, that there is a lack of fast connections between potential labor markets in urban areas, which are geographically close but separated by open water.

2023 January

- Nordic Region

- Transport

Existing routes with time benefit for electric aviation

The map visualizes all routes with significant travel time benefit, which are already served with commercial flights. Information on existing routes has been obtained from the report Nordic Sustainable Aviation (Ydersbond et al, 2020) and applies to the year 2019. Since then, routes may have been added or removed, which is important to bear in mind in future investigations. However, choosing a later year risk giving equally misleading results, as flights decreased drastically during the pandemic. Statistics for 2019 provide a picture of the demand that existed before the pandemic, which is the latest stable levels that can be obtained. Whether air traffic will ever return to the same levels as before the pandemic is too early to say. The majority of routes are found in Norway, along the coastline, which confirms earlier knowledge that Norway has a more extensive and coherent aviation network than the rest of the Nordic region.

2023 January

- Nordic Region

- Transport

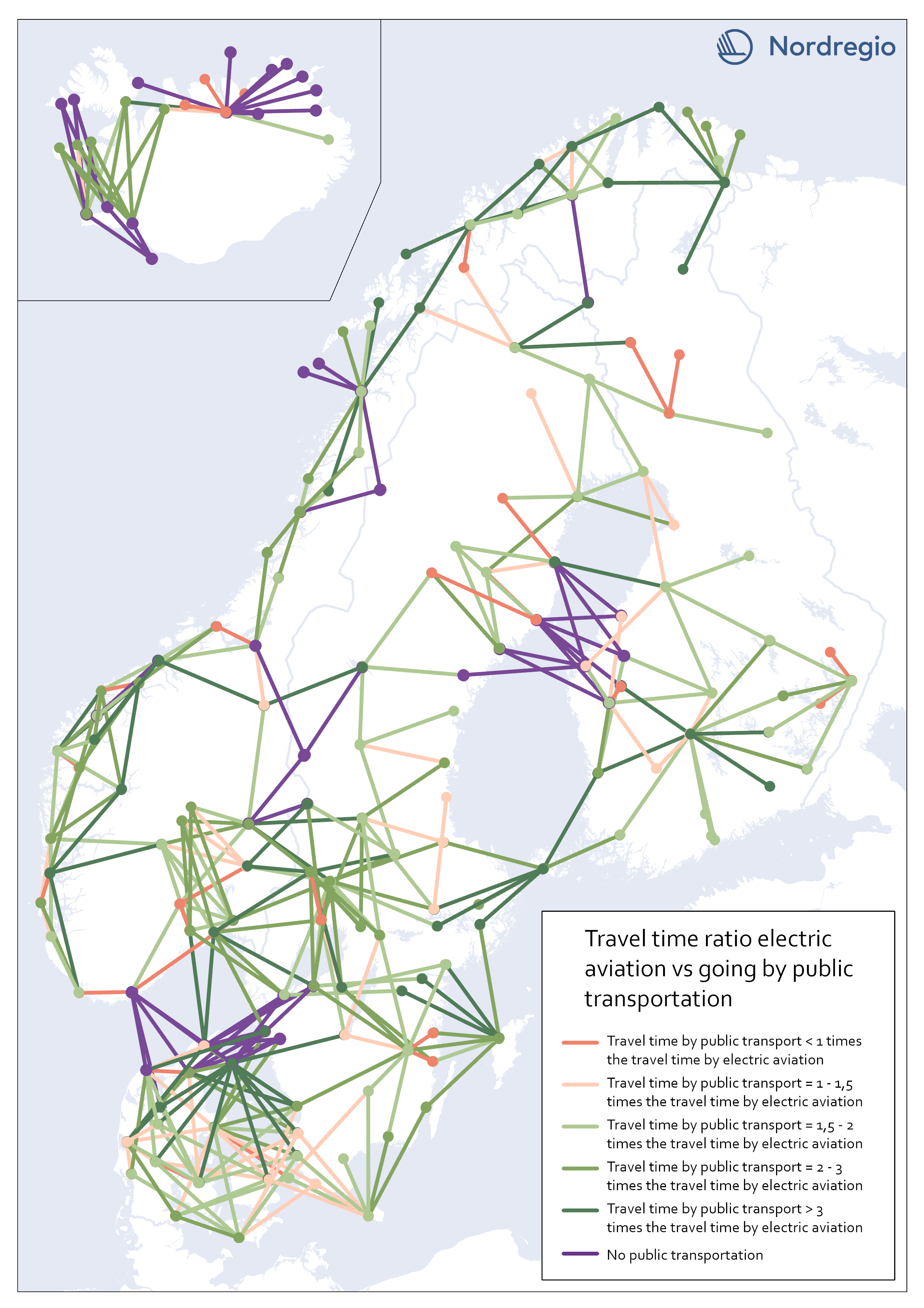

Travel time ratio – electric aviation vs public transportation

This map shows the travel time calculations for electric aviation versus travelling by public transportation. Routes represented by any nuance of green, are routes with significant travel time benefits for electric aviation in comparison with public transportation. The darker the nuance of green, the larger time benefit for electric aviation. The beige color represents routes where the travel time for public transportation is the same or up to 1,5 times the travel time for electric aviation. The red color represents routes where public transportation is faster than electric aviation. Purple lines represent routes where no public transportation is available. These were also routes where we could see significant time benefits for electric aviation. The number of changes when commuting with public transport may have a negative impact on perceived accessibility. In this accessibility analysis, however, we stay with the same criteria for public transport as for travel by car. For future research, the number of changes when commuting by public transport could be considered in the comparison.

2023 January

- Nordic Region

- Transport

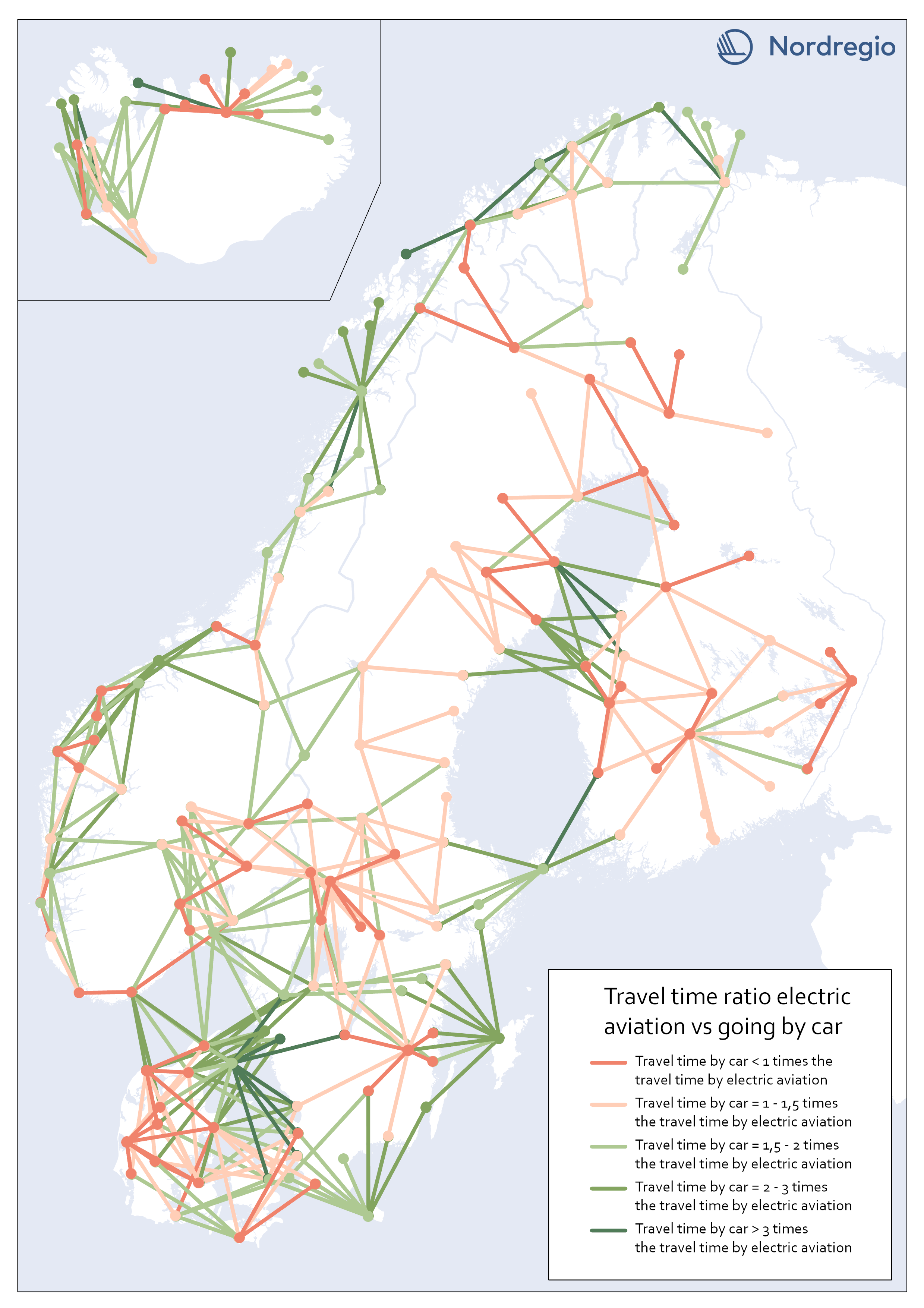

Travel time ratio – electric aviation vs car

This map shows the travel time calculations for electric aviation versus traveling by car. Routes represented by any nuance of green, are routes with significant travel time benefits for electric aviation in comparison with car. The darker the nuance of green, the larger time benefit for electric aviation. The beige color represents routes where the travel time for car is the same or up to 1,5 times the travel time for electric aviation. The red color represents routes where car is faster than electric aviation.

2023 January

- Nordic Region

- Transport

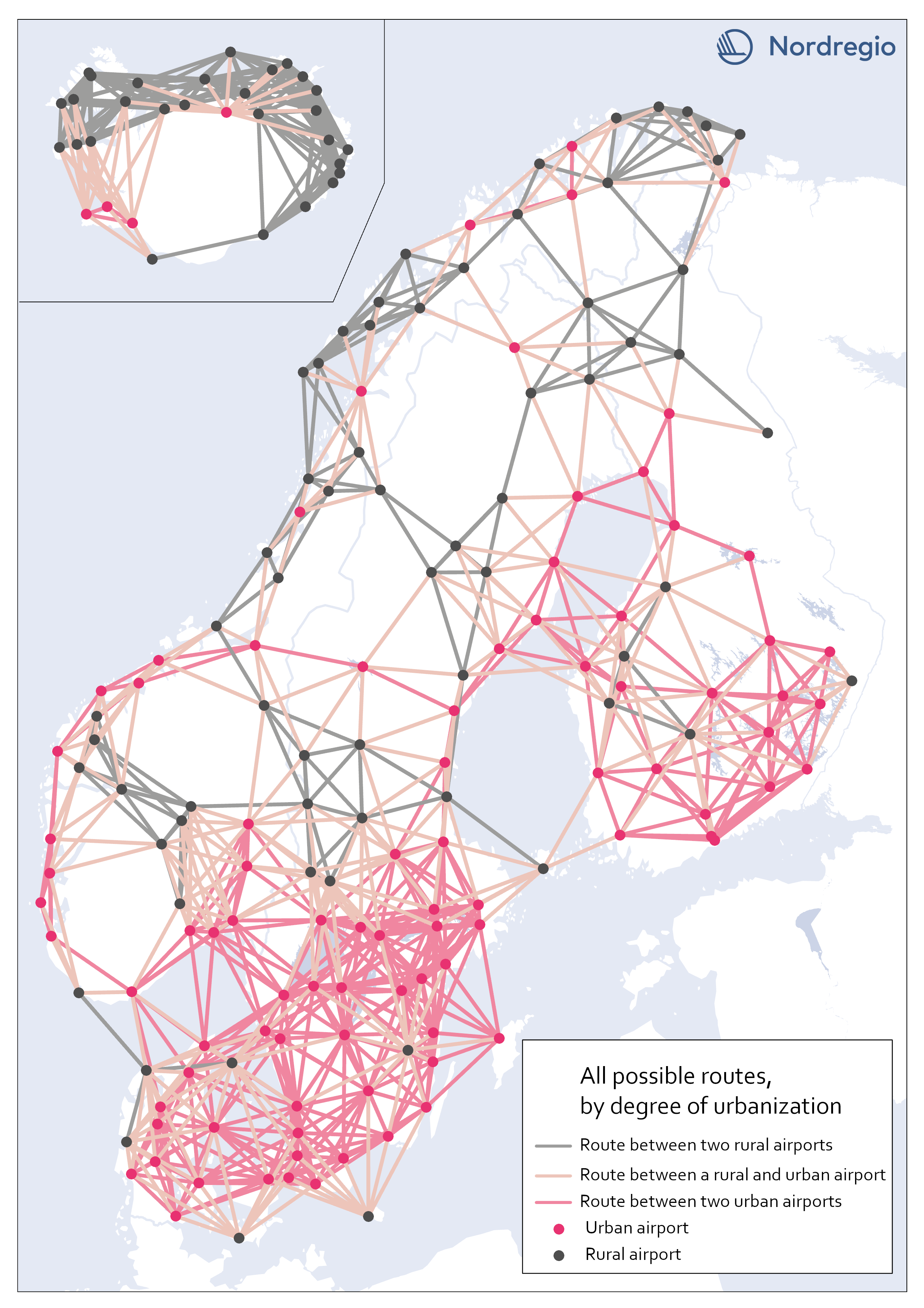

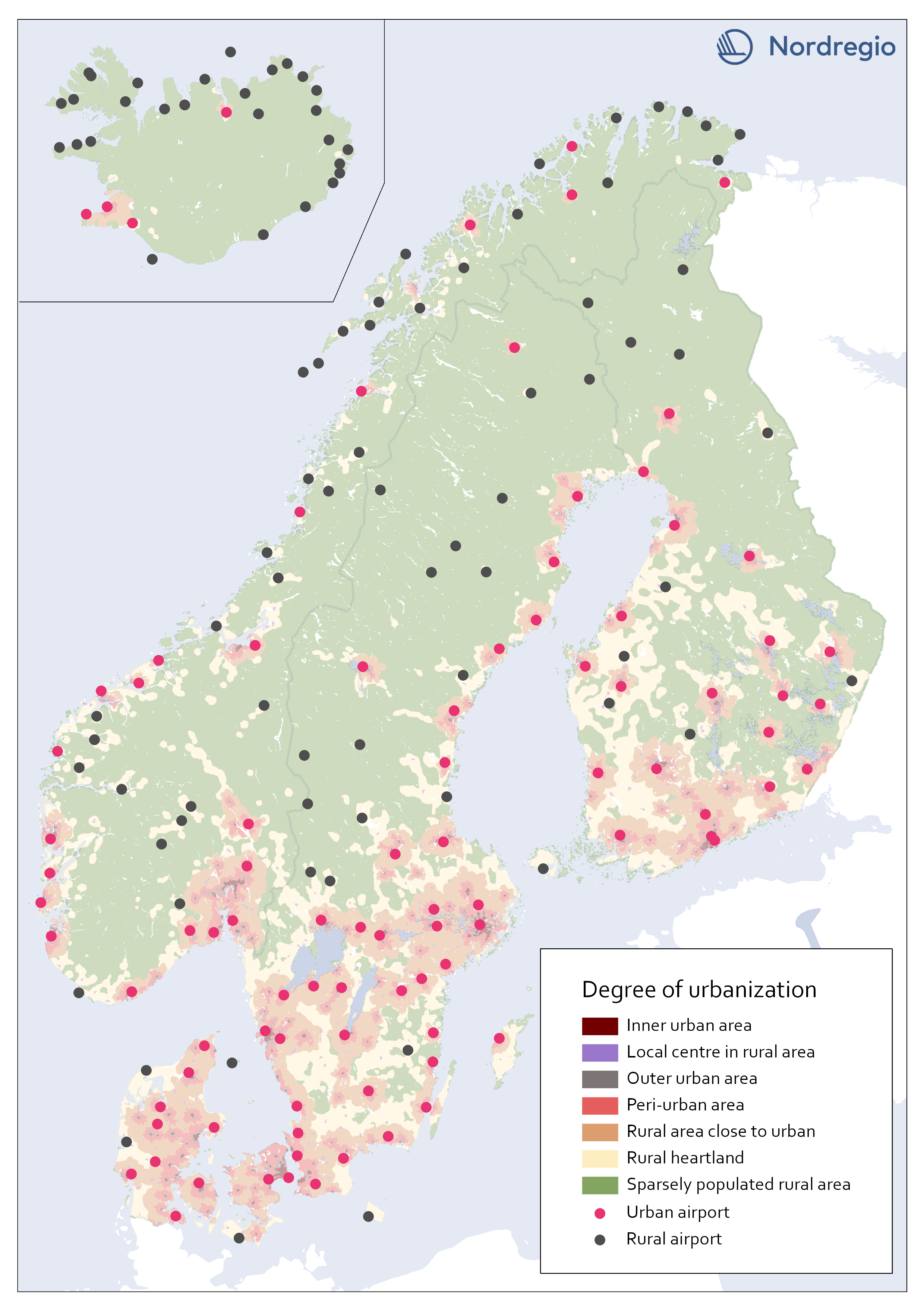

All possible electric aviation routes by a degree of urbanisation

The map shows all routes with a maximum distance of 200 km divided into three categories, based on the airports’ degree of urbanization: Routes between two rural airports, routes between one rural and one urban airport and routes between two urban airports. The classification is based on the new urban-rural typology. We restricted the analysis to routes between rural and urban areas as well as routes between urban areas that are separated by water. Those are 426 in total. We based our criteria on the assumption that accessibility gains to public services and job clusters can be made for rural areas, if better connected to areas with a high degree of urbanization. Because of possible potential to link labor markets between urban areas on opposite sides of water urban to urban areas that cross water are also included. This is based on previous research which has shown the potential for electric aviation to connect important labor markets which are separated by water, particularly in the Kvarken area (Fair, 2022). Our choice of selection criteria means that we intentionally ignore routes where electric aviation may have a potential to reduce travel times significantly. There might also be other important reasons for the implementation of electric aviation between the excluded routes. Between rural areas, for example, tourism or establishing a comprehensive transport system in the Nordic region, constitute reasons for implementing electric aviation. Regarding routes between urban areas over mainland, the inclusion of more routes with the same rationale as above – that significant time travel benefits could be gained between labor markets with electric aviation (for example between two urban areas in mountainous regions where travel times can be long) – can be motivated. Some of those routes can be important to investigate at a later stage but are outside the…

2023 January

- Nordic Region

- Transport

All airports in the Nordic region by a degree of urbanisation

This map classifies all airports by a degree of urbanisation. The classification is based on the new urban-rural typology. We classified all airports localized within any of the top five urbanization classes (Inner urban area, Local center in rural area, Outer urban area, peri-urban area, or Rural area close to close to urban) as Urban. All other airports, localized within the bottom two classes (Rural heartland or Sparsely populated rural area) were classified as Rural. No adjustments were made based on the proximity of the airports to urban areas. During the process we considered adjustments in the categorization based on the airports’ potential catchment area from a close urban area. For example, one can assume that Gällivare Lappland airport in the north of Sweden, has its main catchment area from Gällivare which is classified as a local center in rural area (i.e. Urban). The airport, though, is localized within the category Rural heartland. Yet, we decided to let the typology determine to which category each airport belong.

2023 January

- Nordic Region

- Transport

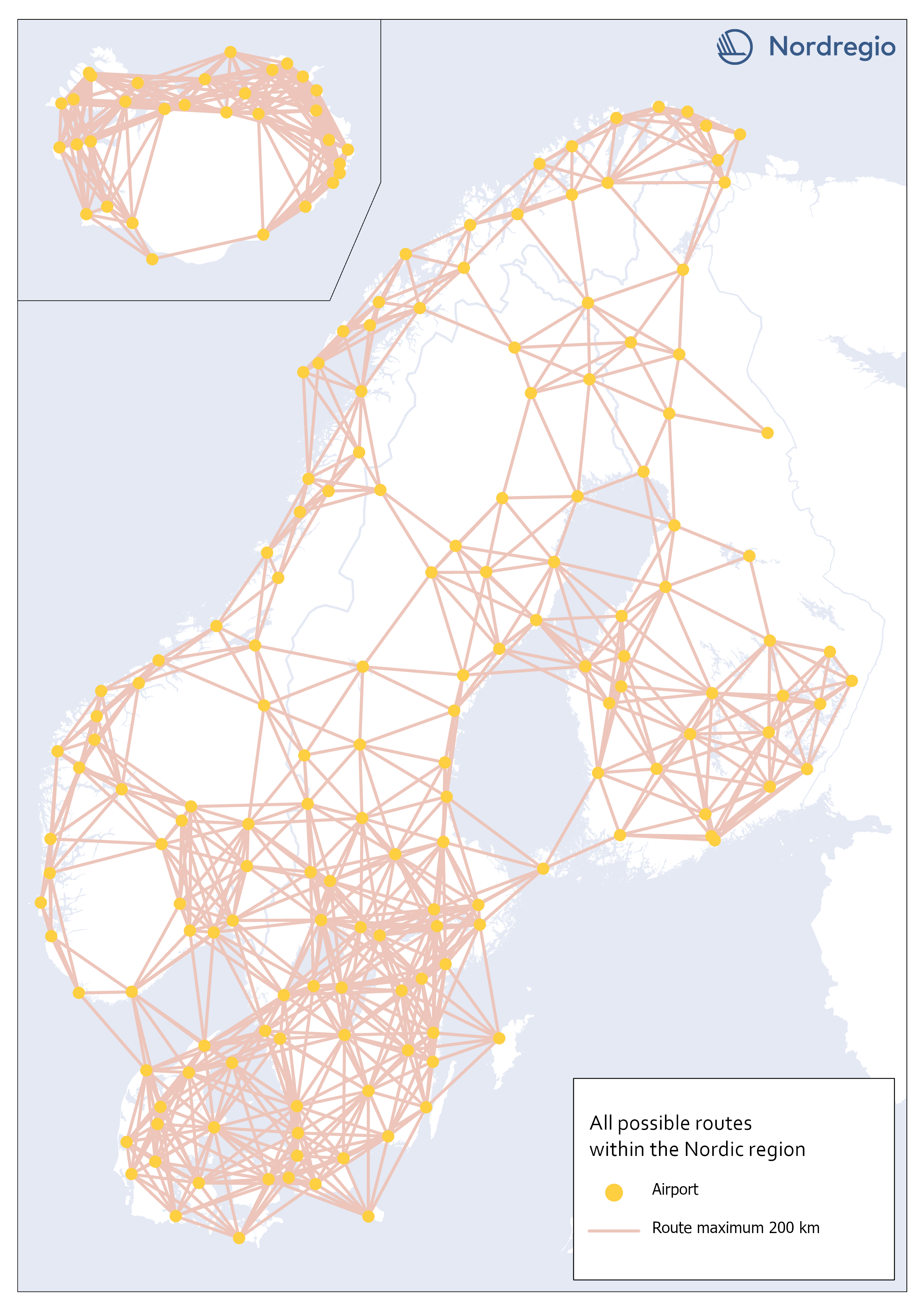

All possible electric aviation routes, max 200km, within the Nordic region

This map shows all possible electric aviation routes of a maximum distance of 200 kilometres within the Nordic region. First generation electric aviation will have a limited range due to battery capacity. According to the report Nordic Sustainable Aviation, routes up to 400 kilometers constitute an initial market for electric airplanes in the Nordic region. However, also shorter distance routes under 200 km, where cruise speed is less important and in sparsely populated regions where passenger volumes are very small, will be the focus (Ydersbond et al, 2020). The first generation of aircrafts that rely solely on electric power have a defined maximum range of 200 km (Heart Areospace, 2022). For this accessibility study, we only included routes of a maximum distance of 200 kilometers. This selection gave us 1001 possible routes in total.

2023 January

- Nordic Region

- Transport

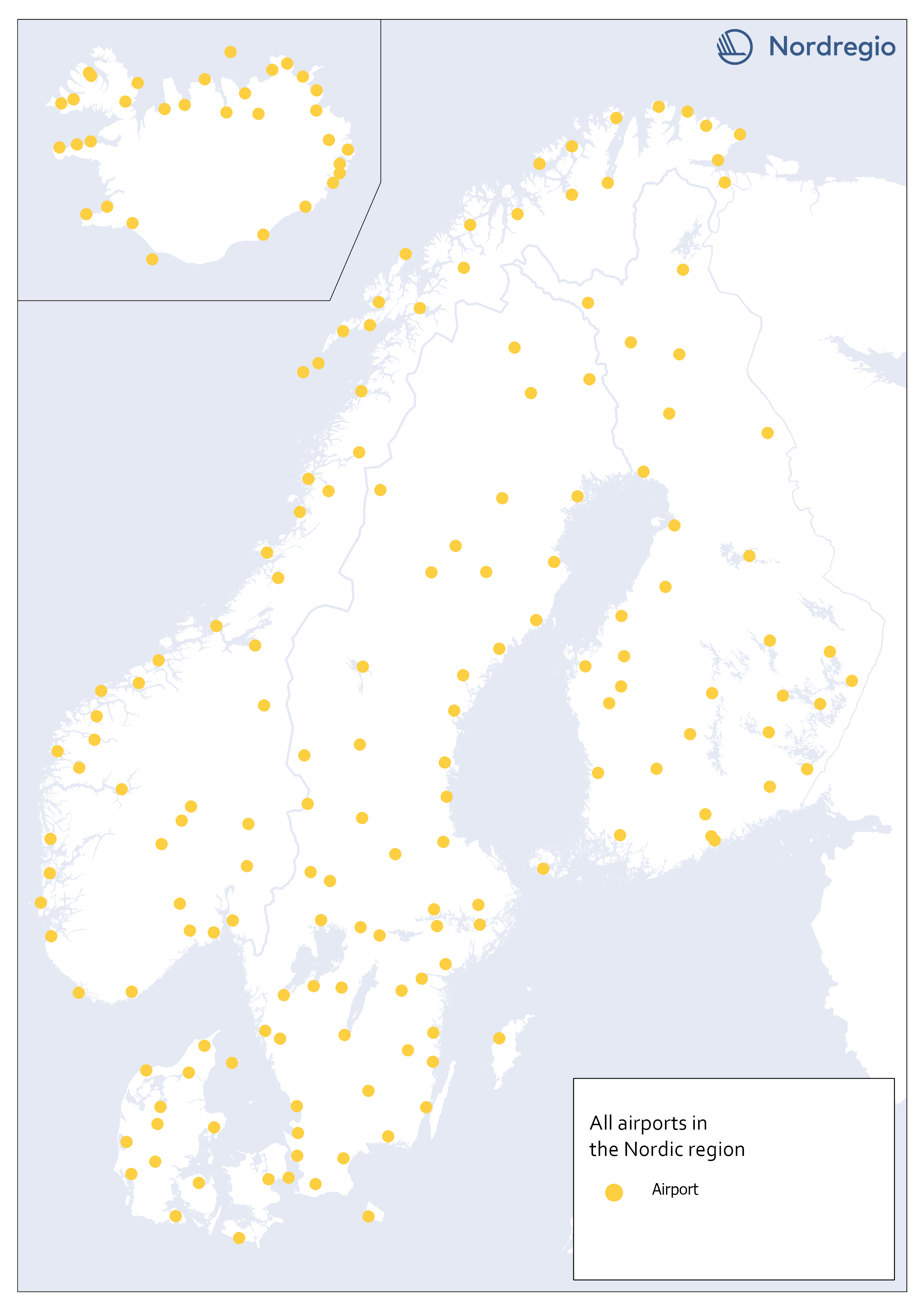

All airports in the Nordic region

This map shows all airports within the geographical scope which may be operated with commercial flight. To limit our selection of airports, we used a combination of two official airport code systems: IATA (International Air Transport Association) and ICAO (International Civil Aviation Organization). IATA-codes specify the airport as a part of a commercial flight route. However, the IATA system, is not solely limited to airports. Other locations, such as bus or ferry stations can also apply for an IATA location code, as long it is included in an airline travel chain. The ICAO-code, on the other hand, indicates that the location is an airport, but not necessarily for commercial flights In order to obtain a selection of airports that met our criteria, an airport was included only if it had both an IATA-code and an ICAO-code. Three different sources are used: 1) Swedavia (lists all airports in the Nordics that Swedavia traffics today). This is our main source, but it does not include all existing airports in the Nordic countries. Therefore, we also use two other sources: 2) Avcodes: Airport code database, from which other airports, that are not served by Swedavia, are obtained. 3) Wikipedia. Finally, the listed airports are checked against Wikipedia, to verify if any airports have been missed through the other sources. This selection gave us 186 airports in total.

2023 January

- Nordic Region

- Transport